Growing up, you are told you are too young to do so many things.

You’re too young to drive a car. You’re too young to own a phone. You’re too young to travel alone. You’re too young to wear makeup… the list goes on.

Now, in your 20s, you think yet again that you are too young to buy life insurance. You probably believe it’s for old people. But here’s some news –you’re old enough.

If you are old enough to worry about those you love, move out of your parent’s home, find bae, or have kids – then you’re also old enough to buy life insurance.

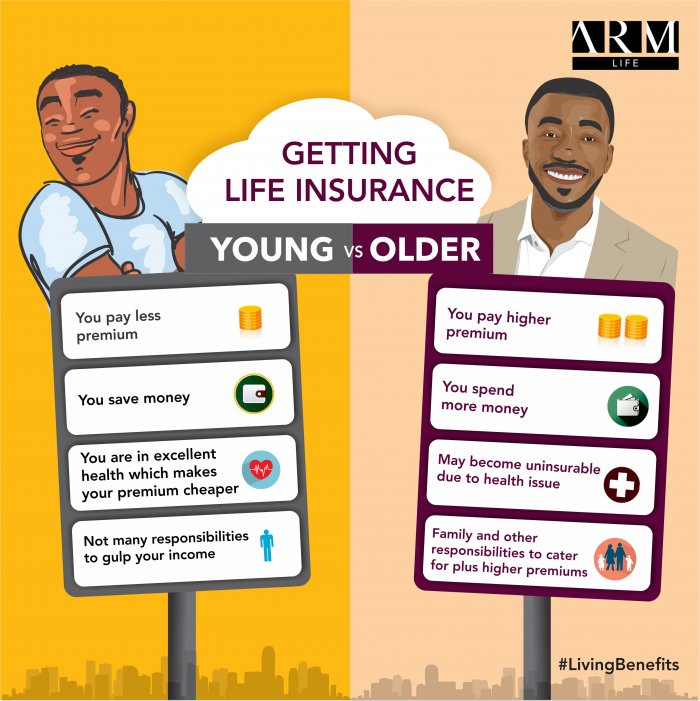

As you think seriously about getting your finances in order this year, you should consider buying life insurance now rather than later. Here’s why:

Younger means cheaper

When you buy life insurance young, you pay lower premiums. Paying lower premium means you save more money as against waiting to get older. And who doesn’t like the thought of saving more? The risk of waiting is that as your age climbs, so do your premiums.

Also, the older you get, the more your rates increase over the previous year – this is because the cost of life insurance depends on many factors which include policy type, death benefit amount/sum insured, your age and health status at the commencement of the policy.

Healthy equals cheaper

Health is one factor that is more important than age in determining an applicant’s life insurance risk.

Should you buy life insurance before you have a serious need for it?

Again, the answer is Yes. This is because other than death benefit or protection of those that depend on you, life insurance is an important part of a successful and balanced strategic financial plan.

One big reason you should start financial planning early is because it enables you make sensible decisions about money that can help you achieve your goals in life. Imagine the awesomeness of achieving great financial goals even before you are 40.

Cost of waiting until you get older?

Consider this scenario:

Let’s say that you are 25 years old, single, no kids, and in excellent health. You can buy a life insurance policy with a sum assured (guaranteed amount upon which your regular bonuses are calculated) of N10million, which will be about enough to cover the average young family. The premium for this policy will be N134, 000 per year.

Now let’s assume that you decide to wait to purchase life insurance until you are married and have children, at about age 40. The cost for the same policy for sum assured of N10million will increase to N144,000 per year. That’s an increase of N10,000 in the amount of money you pay for your policy! Worse, it could come at a time when you have family obligations, and extra cash will be short.

At age 55, that same policy for sum assured of N10million will be N232,000 per year. You see the difference now?

Bottom-line: While you ball and deal with other financial priorities you have as a young adult, it is important that you don’t neglect your future and the role life insurance could play in the lives of those you love.

It will be cheaper to buy life insurance now, while you are young and in good health, than it may be many years down the line when you have a family to care for and responsibilities to deal with.