With the New Year in sight, it is normal for every investor – including you – to feel a bit of apprehension. You might begin to wonder what the future holds, how the market will fare and whether to increase your investment. All these are valid thoughts and we’ve gone ahead to gather answers to your silent questions.

How 2019 looks for you as an investor

In the Equities Market:

In 2019, the Nigerian economy will stay focused on oil prices output and the currency. These factors, we believe weigh heaviest on investor confidence, and exerts significant influence on our macro environment.

However, while major sell-offs continue to take hold on the equity market, smart fund managers like ARM will continually seek and take advantage of lower prices to position on securities with sound financial and positive earnings growth prospects.

On Fixed Income:

In 2019, there is a high possibility for tighter interest rate environment hinging on high maturity levels and Foreign Portfolio outflows due to hike in Federal Reserve rate and perceived election risks – plus possible higher borrowings by the Federal Government. More so, the likelihood of an increase in fuel price in 2019 will stoke inflationary pressure and force the monetary policy to keep interest rate elevated.

Knowing all of these, we will invest near maturing instruments in short-term instruments taking advantage of the attractive rates that we believe are available in the near term.

What this means for you as an investor

This means that the thought of how your investment will fare in 2019 should no longer make you panic because, regardless of what the economy may look like, there is already a plan in place to combat any possible glitch the market may encounter.

Past fund performances and track record of ARM Investment Managers are pointers to how safe your investments are with us. Look at how our funds have performed in the last three years. Based on presented statistics, you can rest easy knowing that your investments are safe and growing. This is also a positive nudge to consider increasing your investment in the New Year.

Benchmark breakdown

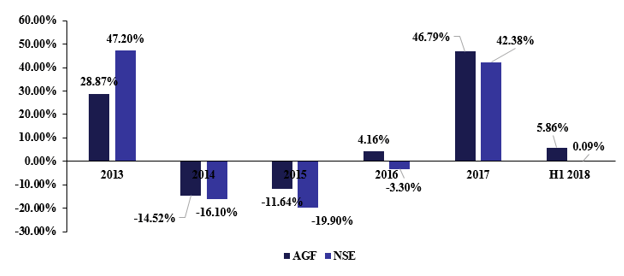

Aggressive Growth Fund

ARM AGF comprises of equities (87%) and fixed income (13%). This means that its return is determined by the performance of these respective indexes. Over the last 4 years, AGF and the NSE Index have followed the same trend, with ARM outperforming its benchmark in 2014 – H1 2018.

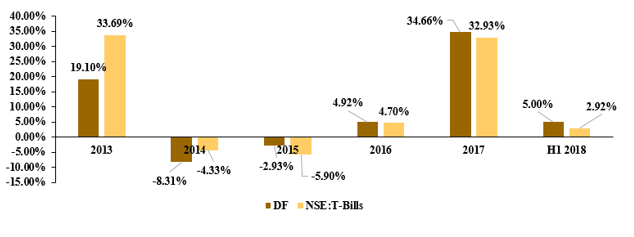

Discovery Fund

ARM DF comprises of equities (62%), fixed income (37%) and real estate (1%). As a result of its composition ,it is benchmarked against a ratio of the NSE index (equities) to T-Bills (fixed income). DF lagged behind its benchmark in 2013-2014. However, from 2015 – H1 2018 DF outperformed its benchmark

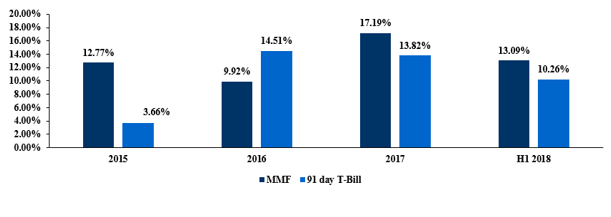

Money Market Fund

ARM MMF is benchmarked against the 91-day T-Bill. In 2015, 2017 and H1 2018, the yield from ARM’s MMF outperformed its benchmark.

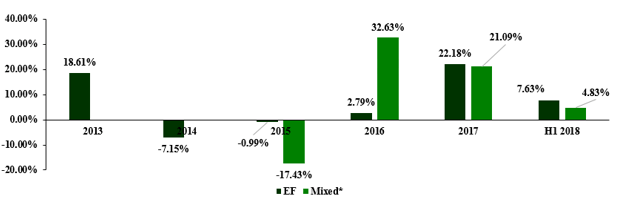

Ethical Fund

ARM Ethical Fund’s benchmark is based on the performance of Lotus, Skye Shelter and Osun Sukuk. EF outperformed its benchmark in 2015, lagged in 2016 and has seen improvements in its performance over the last year.

We are available via enquiries@arminvestmentcenter.com or 0700 CALL ARM should you wish to get in touch with us.

Thank you.