Is there a reason you behave a certain way when it comes to your finances? The answer is YES. This is because your response and behavior with money are mostly due to your money personality.

Understanding your money personality is the first step that will help you know how best to approach saving, spending, and investing in order to achieve your goals (whatever they may be).

Now let’s look at the different money personalities to see where you fit in:

The Saver:

Do you turn off the lights during the day to save power? Or shop only when it is necessary and perhaps rarely make purchases with a debit card to avoid overspending? Chances are, you’re not in debt and are not big on buying things because they’re in trend. You probably also opt for low to medium risk investments and would never fall for a get-rich-quick scheme because you can’t afford to lose money.

Verdict: If this sounds like you, you’re a saver. But exercise moderation to avoid pinching your money and taking the fun out of life. While minimizing risk is any good investor’s primary goal, reducing risk while increasing return is what makes an investment strategy successful. Here below are some investment options to help you reduce risk and maximize returns.

Mutual Fund recommendation:

ARM Money Market Fund – Open-ended, Low risk, capital appreciation, liquid investment, and N1,000 to start investing.

ARM Fixed Income Fund – Capital appreciation, affordable, access to a diversified portfolio, and more.

Savings recommendation:

Retirement inches closer with each passing day and you don’t want it to meet you unprepared. Along with other investments, consider matching your employer’s contribution to your retirement savings with an Additional Voluntary Contribution. Voluntary contributions are invested and managed in the same thorough manner as your regular pensions contributions.

The big spender:

A lover of luxury cars, new gadgets, and brand-name clothing – hello!!! Is that you? You don’t have time to seek bargains, always looking to make a statement with your fashion with an overpowering desire to live in the most beautiful home, own the latest gadgets, and live in luxury.

You are not trying to keep up with the Joneses – you are in fact the Joneses people try to keep up with. You’re comfortable with spending money, not afraid of debt, and often take big risks when investing. If you found yourself nodding while reading this part, your money personality is not in question.

Verdict: Dear Mr./Ms. big spender, before you splurge on something expensive, ask yourself if that item will hold the same value to you in a year. If the answer is “not really”, skip that purchase and consider investing it for the long-term in any of the below where it will yield competitive returns.

Mutual Fund recommendation:

ARM Eurobond Fund – Provides competitive returns more than that of an average domiciliary deposit account, long-term capital growth, diversified portfolio, and more.

ARM Aggressive Growth Fund– Provides long-term wealth growth, competitive returns, capital appreciation, expert fund management.

Savings recommendation:

You can also build up your retirement savings by making Additional Voluntary Contributions to ensure that you have enough to maintain your current lifestyle when you retire.

The Shopper:

Do you only feel emotionally satisfied when you spend money? It’s like your village people are always pushing you to spend even on items you don’t need… You know you don’t want to buy that dress or shoe, but something pushes you to buy it even if it means buying it on ‘credit’. You know you shouldn’t be shopping impulsively in order not to end up broke, but there you are again waiting for Easter sales or Black Friday deals…

Verdict: Are you sweating now? Yes? Then this is your money personality. Before you dig yourself into a hole of debt or broke-ness, here below is our recommendation on how to put that money to use by planning and investing.

Mutual Fund recommendation:

Invest that extra money in any of the following mutual funds and shame your village people with your level of financial discipline as you grow your money.

ARM Discovery Balanced Fund – Provides long-term wealth growth, competitive returns, capital appreciation, expert fund management.

ARM Fixed Income Fund -Provides capital appreciation, affordable, access to a diversified portfolio, and more.

Savings recommendation:

You might also want to put some towards retirement with Additional Voluntary Contributions especially if you want to live out your retirement in comfort.

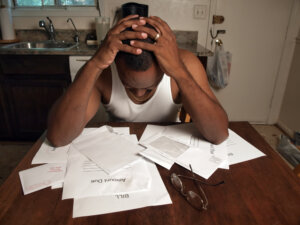

The Debtor:

Debtors don’t spend much time thinking about their money and so easily lose track of what they spend on and where they spend it. If you never keep a budget or never stick with one, spend more than you earn, are heavily in debt, and don’t invest – sadly, this sounds like your money personality.

Verdict: You seem to be The Debtor personality but fear not, you can change your personality by doing the following:

-

Commit to writing a budget and STICKING with it.

-

Track your spending.

-

Set a financial goal

-

Set up an emergency fund

-

Only buy what you need.

-

Automate your investment.

-

Speak to a financial advisor to assist with financial planning.

-

Make additional voluntary contributions to grow your retirement savings.

Mutual Fund recommendation: Plan your finances and start investing in any of the following –

ARM Money Market Fund – Open-ended, Low risk, capital appreciation, liquid investment, and N1,000 to start investing.

ARM Discovery Balanced Fund – Provides long-term wealth growth, competitive returns, capital appreciation, expert fund management.

The Investor:

You are consciously aware of money and understand that when you put your money to work, it grows.

Regardless of your current financial standing or economic situation, you look forward to a day when passive investments will provide sufficient income to cover all your expenses. You are constantly driven by careful decision-making and your investments reflect the need to take a certain amount of risk in pursuit of your goals.

Did we see you smile in agreement with the above statements? Then, you’re definitely an investor.

Verdict: Congratulations! You’re doing a good job – keep doing what you’re doing and don’t stop educating yourself. We’re sure you already have robust retirement savings in place for when tomorrow comes, but you can grow it with additional voluntary contributions to ensure that a comfortable lifestyle at retirement is assured.

Mutual Fund recommendation to help you diversify your investment portfolio: