Daily Market Update (Equities)

The Nigerian stock market continued its downward trend today, losing another 0.10%. This marks the second consecutive trading day of losses, bringing the market’s year-to-date (YtD) return down to 30.38% (from 30.51% YtD yesterday). Market capitalization took a hit, shrinking by NGN56.12bn. This negative sentiment was on the back of losses in OANDO, UBA, FBNH and ACCESSCORP, offsetting gains recorded in JBERGER, NB, INTBRW and LASACO.

Only the Consumer Goods sector managed to buck the trend, eking out a small gain of 0.31%. Meanwhile, the Banking, Oil and Gas, Insurance, and Industrial Goods sectors all faced declines.

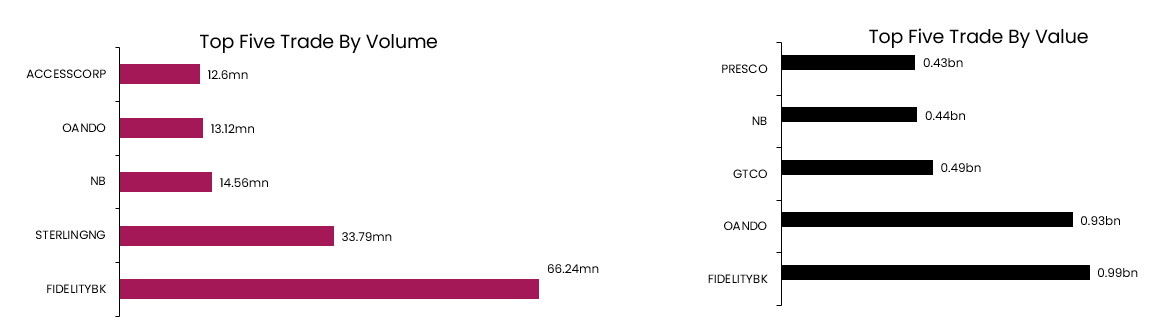

Similarly, trading activity declined, with the total volume and value traded down by 50.48% and 16.65% each to close at 356.13mn units and NGN6.95bn, respectively. FIDELITYBK traded the highest in terms of both volume and value.

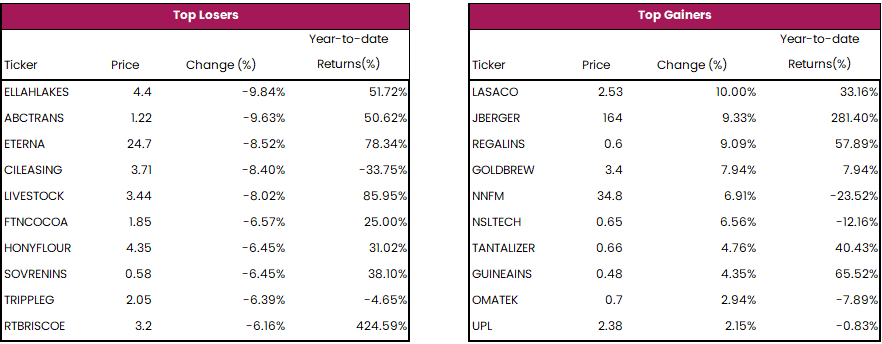

Today LASACO, JBERGER and REGALINS led the gainers chart, while ELLAHLAKES, ABCTRANS and ETERNA led the laggards.

Daily Market Update (Fixed Income)

The Nigerian fixed income market concluded today on a positive note, with the average yields in the NT-bills market down by 0.06% to settle at 22.87%. This is following buying interest in the short and mid-tenor treasury bills. On the flip side, the FGN bond market closed flat with the average yields at 19.08% for the third consecutive trading day. Overall, the Naira fixed income market ended positively as the average yields fell by 0.03% to 20.98%.