Daily Market Update (Equities)

Today, the Nigerian stock market closed on a positive note as it gained 0.19% while its year-to-date return settled at 30.67%. The Market performance was driven by gains in FIDELITYBK, UBA, and DANGSUGAR, offsetting losses in ACCESSCORP, WAPCO, and TRANSCORP. On a sectoral basis, the Banking (+0.81%), Consumer Goods (+0.40%), and Oil and Gas (+0.22%) sectors closed in the green. Conversely, WAPCO and WAPIC dragged the Industrial Goods (-0.14%) and Insurance (-0.50%) sectors into negative territory.

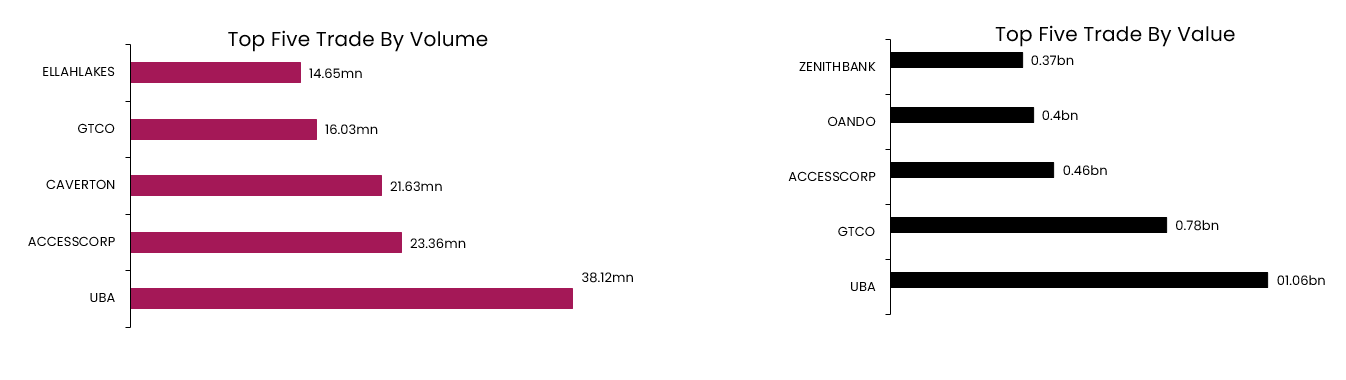

Today, the total volume traded was 1.31bn units, while the total value traded was 5.96bn. UBA made its top position in both volume and value traded.

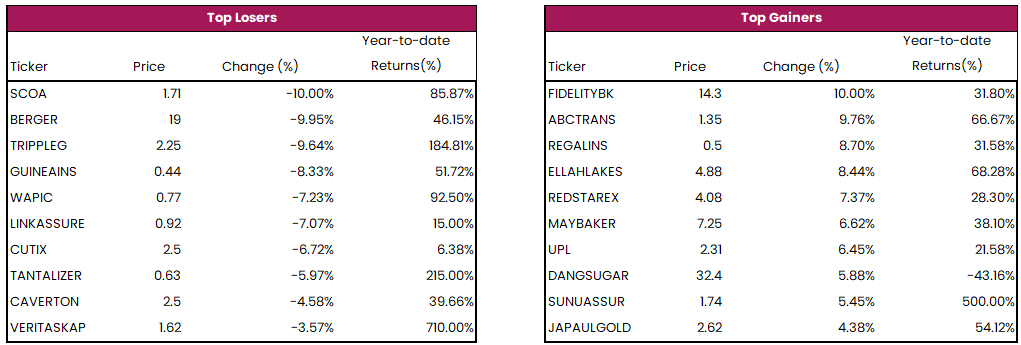

Top gainers today were FIDELITYBK, ABCTRANS and REGALINS. On the other hand, SCOA, BERGER and TRIPPLEG topped the losers’ chart.

Daily Market Update (Fixed Income)

The fixed income market started the week with yields continuing their upward trend, as the average yield in the NT-bills market rose by 0.27% to 22.95%. This increase was driven by selloffs in mid-tenor (+0.20%) and long-tenor (+0.29%) treasury bills. However, the FGN bond market remained unchanged, with the average yield holding steady at 19.08%. Due to the higher yields in the NT-bills market, the overall fixed income market closed negatively, with the average yield increasing by 0.13% to 21.01%.