This month did not quite start on a high. Five long weeks of August left you wondering if September would ever come. Your salary had not even settled in your account when ‘Happy school fees week’ posts reminded you of the school teller sitting in your bedside drawer. If only you had saved consistently in your Money Market Fund, it would probably have been enough to settle the school fees.

On your way to work, you hear the OAP lament on the radio that the government can’t be right, recession is not over. Hmm, this recession matter, if the government is seeing a silver lining, maybe it is time to buy FGN Bonds or Treasury Bills. So, you log in to ARM STOCKTRADE and discover there a few gainers on the stock market, you make a mental note to buy bonds and maybe a few shares when salary comes.

Three weeks into the month, ASUU calls off the strike finally. You wonder if the education system will ever thrive again. If you have your way, your children will school abroad. They are only in primary school though, still a long way off. Yet, you wonder how much you would have in 5 years’ time if you just drop 15k into an account every month. Wait, isn’t that what the ARM Education Plan is about? Mostly. Except that you get an interest and it converts to insurance if things don’t go as planned? Sounds good actually.

That night, in bed, you realise what the real problem is. You want to save, you know you should invest but you hardly get around to doing it. It’s that time of the month and already you can see it happening again. All the tiny-tiny expenses rearing their heads, the little foxes that mess up your plans.

Not again, not this month.

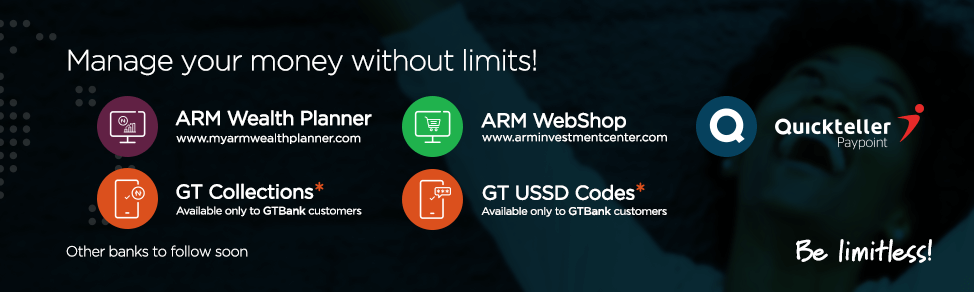

So you set up a Direct Debit mandate on the ARM Wealth Planner. There! such a simple step and your monthly savings are guaranteed.

September now has a new meaning. It will be remembered as the month you took charge of your life.