Every week, we ask anonymous people to give us a window into their relationship with the Naira – their secret Naira Life.

This week’s story pulled off in collaboration with ARM Investment Managers. They have a diverse range of Mutual funds for everyone looking to give investments a shot, from beginners to the rans. Find out more.

When was the first time anyone paid you money for work?

200-level. I used to sell cooked noodles in the hostel. I wasn’t really keeping track of the numbers, but I just needed extra cash to add to my pocket money from home – the money my dad was giving me wasn’t enough –10k.

Then I started looking for what else students needed but couldn’t get. Our school was remote, so I started selling headphones and memory cards because everyone needed it and couldn’t travel far to get it.

This was 2009. I had outlandish dreams of what University was supposed to be; a place where everything was possible and all that. Well, that was the year that dream died. I just focused on the practical courses and coasted through the abstract shit.

First Semester in 300-level, I first saw Photoshop on someone’s computer in an Entrepreneurship class. Not too long after, I went to meet this guy in my hostel and asked for the full Adobe Suite. Next thing, I’m installing. Next thing, I’m looking for tutorials.

By the next morning, I was going round the hostel, showing everyone what I’d just designed; my first logo ever.

By 400-level, I was just about that selling phone life. I sold up to 20 phones then, most of them Blackberries. I tried to pick out fancy Blackberries – the white ones, the purple ones, the red ones. Just the colourful fancy stuff that I knew they’d like. Everyone wanted to stand out.

What came next?

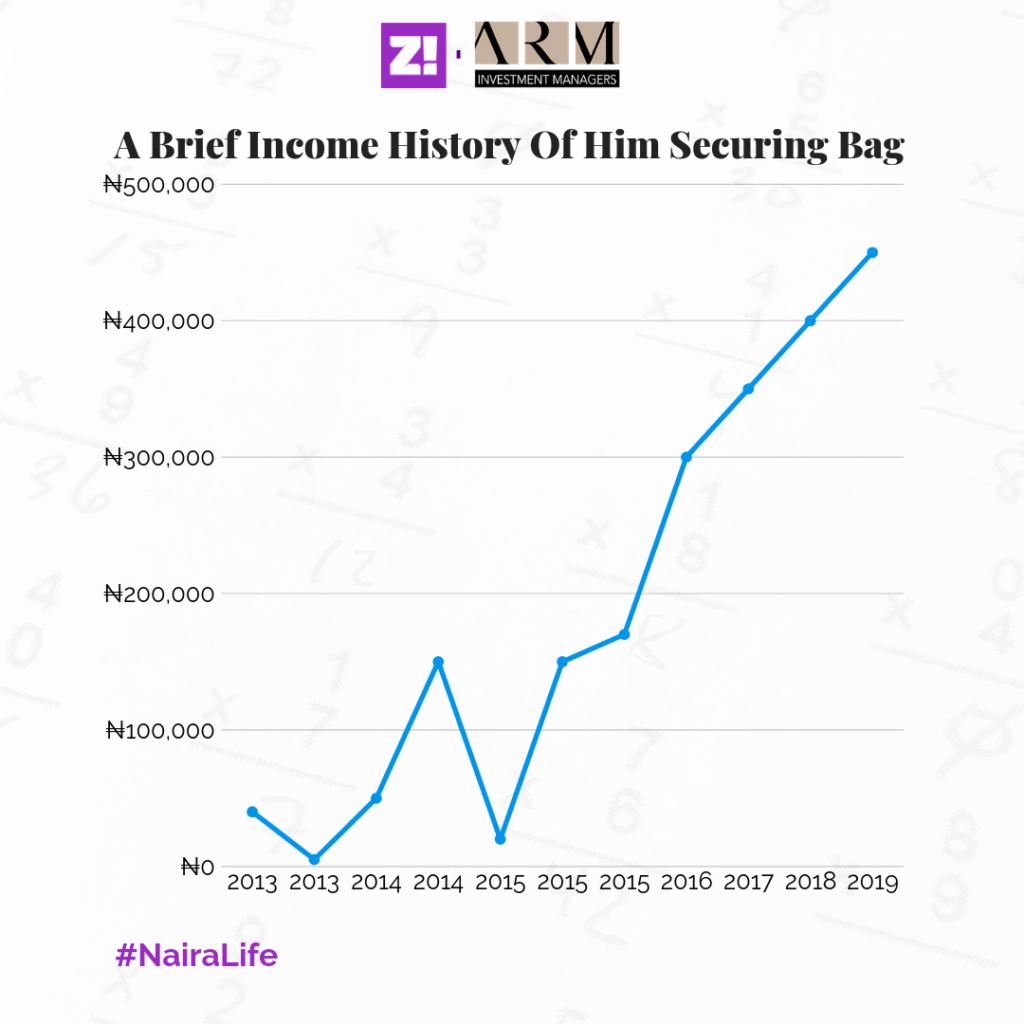

I went for NYSC in the Southeast in late 2012, but I was getting gigs from Twitter, a logo here, a poster there. I even helped a rapper design the cover art for his song. One of your faves. It was a hit too.

How much did he pay?

EX-PO-SURE.

That wasn’t what I asked for though.

Anyway, NYSC was giving me ₦19,800, my place of assignment was giving me ₦10k. Those random gigs were probably giving me ₦5k per month. I remember that time, I’d send the logos and everything to the clients from the really bad Internet on my phone. I lived in a village so ₦10k a month was enough. I saved the rest and bought two budget smartphones – one for myself and one for my mum.

Post-NYSC?

I was jobless for like 6 months, in the true sense. Then one day, my dad came and said his friend wanted someone to take photos and design flyers for his hotel. The man paid me ₦10k, it was also the first time I saw my work in print.

Around that time, my mum was like “why don’t you apply at a bank or something instead of staying at home? What if you never get a job with this your design thing.”

Mummy, I’ll get.

You can’t work in a bank?

I can. But getting hired in a bank back then mostly meant you had to sit all day at the desk attending to deposits and withdrawals. I didn’t want that.

I had one more cousin staying with us who was also unemployed, so that kind of took away some of the pressure. One some days, I was focused on becoming a better designer and not staying idle. On other days, I was sleeping for the entire day.

To be honest, I was purposely not applying for jobs that she wanted me to apply for. I was looking for advertising agencies. Since Uni, I was really obsessed with having my work on a billboard one day.

So, your first full time gig?

Late 2013. I applied to this music blog, and the owner offered ₦40k in the first month. By the second month, he told me “guy, I honestly can’t afford to pay you. These ads don’t seem to be coming. I’m sorry.”

And that one ended. He was a nice guy though.

After that, I was jobless again for a few months. Then a friend introduced me to this small agency that needed a graphic designer. I took the test, got in, and they started me at ₦50k. About four months into that gig, I went to a small Ad school, and in our final branding task, an agency saw my work and they made me an offer.

So I joined this new agency in late 2014, for ₦150k a month. Payroll issues and they had to shut down business after about 6 months of joining, while still owing two months of salary.

Did they pay up?

They did, a year and a half later. In the time being, I was back to just random freelance gigs after they couldn’t pay, but that lasted for about 2 months. Another friend called and said a Food Processing Company was looking for a Graphic Designer. He told me the offer was ₦200k. I jumped on it straight up.

I went to the interview with my deadbeat laptop, and these guys needed to see my work. The question was, how quickly can I show them all my work before this laptop goes off like a TV. The laptop managed to come on, and you know what they were most interested in?

What?

My personal experiments. I knew I’d gotten that gig the moment they saw those. Oh, and just as we were wrapping up, my laptop tripped off. Hahaha.

Sha, they made an offer of ₦150k for my probation period. I said I wanted ₦170k at least, but they told me I’d get a 200k bump after probation.

First of all, HR delayed, and when my raise finally came, it was ₦170k I received. And I’m like what’s this nonsense?

That’s when I learned the difference between net and gross salary.

Anyway, I’d already gotten into the job, designing all kinds of things for cartons, to buses, and even the one I’d always wanted, billboards.

One year into the gig, I asked for another raise. I legit wrote a list of everything I’d been doing:

When the brand manager left the company, I had to stand in as Brand manager, working with them to create jingles and all that.

I got that raise. ₦250k, net. Can’t fool me twice.

This was 2016. All this while, I was still doing freelance gigs, but they weren’t as intense, because I was putting everything into the work at the time. So there wasn’t really time for me to actually do them.

Still, freelancing was bringing in another ₦50k every other month.

By 2017, I started learning animation. Besides that, the year was pretty meh workwise. Also, I started learning how to shoot properly in 2017. I actually picked up shooting at work the previous year, but 2017 was when I was experimenting in the wild. I interned on the set of a movie – it never got released though.

2018?

I got another raise towards the end of the year – ₦300k. Worked on another film set. I really just wanted to learn. Then I directed a short film. I actually planned to shoot two short films, but I didn’t have the time – work, relationship. Generally, I think relationships are emotionally, physically, and financially expensive.

Fast forward to 2019, I started getting better at animation and getting more freelance gigs. So to get better, I started an internship. One class a week. Add Youtube tutorials to that. Add two other online courses. 2019, I’m also going to learn code, because if you’re going to animate for web, you need to learn code.

What’s your most important perspective on money, between 2009 and now?

Money is the bread and butter of this world, and there’s no living without it. People are in denial of how important money is. People will tell you to follow your passion, but they won’t teach you how to make money. We go to school to learn about everything, everything but money, which is like the most important thing, post-school. They teach Entrepreneurship, but they should also be teaching personal finance. It’s why we’re all so shit with money.

People shouldn’t be shy talking about money. If you need help on how to make money, say it.

How much do you feel like you should be earning every month?

₦700k, at least. That’s the value I’ve put on my diverse skills at this point in this market.

Let’s breakdown that monthly income.

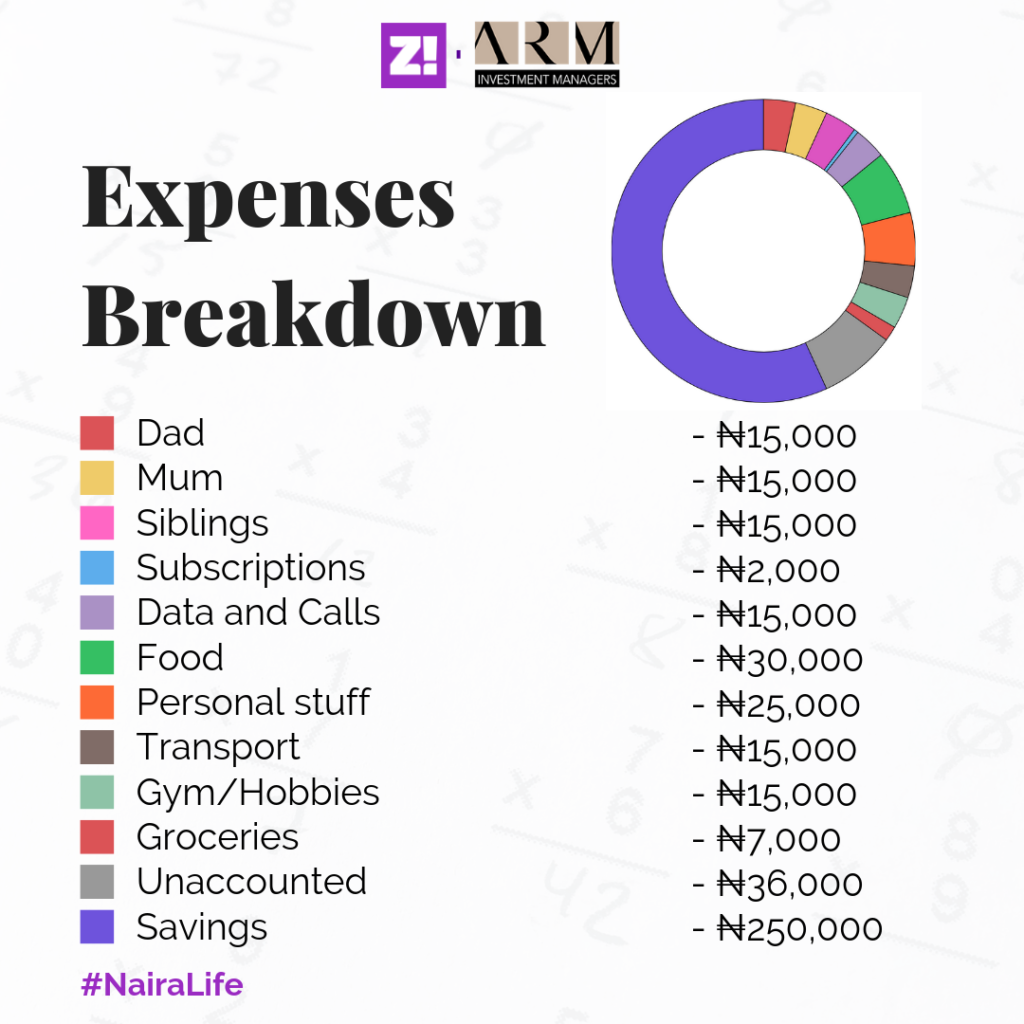

My monthly income is at about ₦450k if you add side hustles. This is what an ideal month looks like:

We haven’t accounted for ₦36k.

Eh ehn? Wait, what am I using this money for? Omo, I dunno o. Maybe that’s my own lau-lau.

When was the first time you sent money to your parents?

I used to send money to my mum, but you see my dad, he’s a very proud man. I assumed he was getting his pension, then my mum told me “he hasn’t started receiving his pension. They keep postponing and postponing, but really, nothing is coming in.”

So I sent him money. ₦30k. He was so emotional and thankful, and told me how it was going to go a long way with some family stuff. This was in 2017, and since then, I’ve made it a duty. It’s been everything from car trouble to school fees. I’m just thankful that I don’t have any other responsibility.

Then there’s the random ₦30k’s to people who are really in a tight spot. Whenever I’m in a position to help, I just step up.

Explain this savings things for me please.

My ₦250k first lands in my savings. I tend to save for stuff I need to pay for, or stuff I need to get. Like rent, or a laptop. My rent is actually fair, ₦300k. So there’s that.

I tried investing in an agric business, but I missed the window. I also have some other long term investments, like stocks. I haven’t tried any other investments.

Why haven’t tried any other investments?

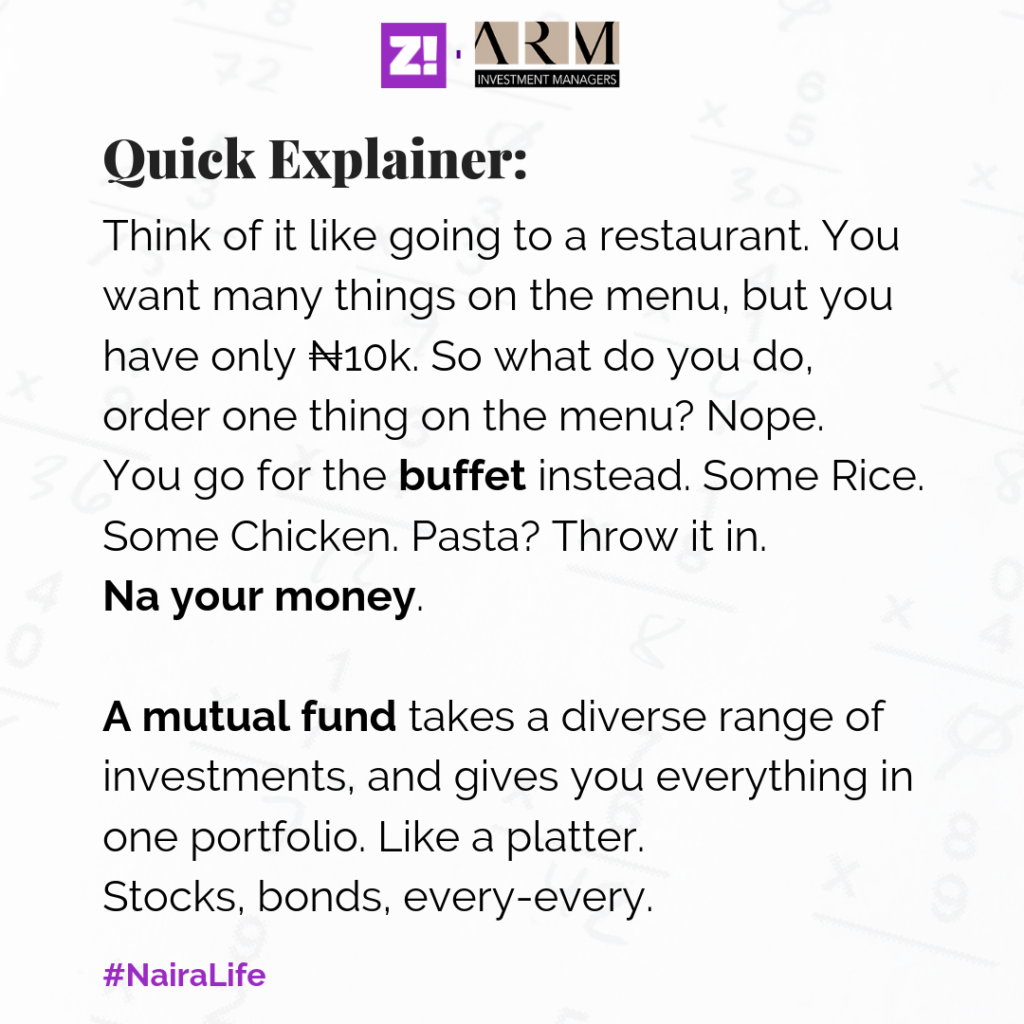

I wanted to try Mutual Funds. But I was unsure about it.

You know how Mutual Funds work?

Not really.

How much do you imagine you’ll be earning in 5 years, and how did you arrive at that number?

1.2… 1-point… ₦1.2 million at the very least (using today’s estimates). It’s mostly because of the skills I have and I’m trying to acquire. And the confidence to even call this amount is because with the skills I’m looking to acquire, there is global demand.

Wait, how much is $6000?

About ₦2.2 million.

Yes. That’s the amount, at least. There’s a price chart for motion designers in the US. The pros earn like $300k a year. On average, I should be looking at $7000 per month, but that -1k is to solve for X, where X is the Nigerian factor.

What’s something you really want but can’t afford?

A beach house. I won’t say a car, because I really don’t find driving as a necessity. An efficient life for me will be Ubers, and Taxifies. Or carpooling.

But I never get the money reach that side, so I dey jump bus.

What’s the last thing you paid for that required serious planning?

I would have said rent, but I already programmed it somehow. It didn’t really require serious planning actually. I just have this thing where I just keep rent money aside.

But serious planning would be my laptop. I paid ₦500k.

When was the last time you felt really broke?

Really broke? How broke?

What is broke for you?

Broke for me is when you’re down to your last ₦50k. Last time I felt like that was two years ago. There’s an amount of money my bank account dwindles to, that I just start to feel sad. When you have money, you’re calm. That’s why people’s voice changes when they’re rich. They take their words slowly. Because money is a nerve calmer.

Actually, this sadness starts to kick in for me when I’m down to my last ₦200k. Rock bottom is now ₦50k.

What’s the most annoying miscellaneous you’ve had to pay for?

My laptop charger. ₦30k. A bloody Macbook. It scattered. It’s one of the things that triggered me to dump my Mac. Those things are ridiculously expensive. That was also my third charger. Anyway, if you must buy a Mac, buy a surge protector.

What’s your greatest fear, right now?

It’s something coming up that I can’t afford, like a family emergency. This fear has never reared its head in any form, but I’ve had hints. Like the health from one of my parents. I’m expecting it to become a problem in the future, so I’m doing my best to delay it as much as I can, by taking as much burden as I can now, whenever I can.

Let’s talk about happiness. On that 1-10 scale.

About my finances? I’m at a 6-7, because I don’t have grand needs. I can afford the simple things; food, clothing, shelter, Internet, transportation. I can even afford to take a holiday. Then my family, I can afford to take care of them.

People tend to ignore the things they could be grateful for in the present because they want to aim higher. I get that, I also like to aim high. But I also like to pay attention and be grateful for the present. I have awesome friends. I have an awesome family. Those things are priceless.

What’s something you want me to ask but I didn’t?

“How many children will you haveee?”

Depends on how financially buoyant I am before I start popping, and after I start popping. But also, that depends on how many my wife is willing to pop. Because no be me get the bẹlẹ́. But if I could, I’d have a lot of children. I’m definitely going to be adopting too.