We want you to know that now is the time to look at the equity investment. Trends show the market is about to rebound and the value of stocks are about to go way up. Invest now while prices are low to make big gains in coming future.

2016 – The Year that Was

2016 was a turbulent year for Nigeria and the domestic investment clime. The Nigerian economy went into recession, inflation spiked to a 12-year peak of 18.57% and the naira lost over 50% of its value at the interbank ($305/N) with the case in the parallel market even more precarious. Irrespective, for Nigeria’s broad financial market, the year was a mixed one. On the one hand, the Nigerian equities market closed negative for the third consecutive year (-6.14%) and FI yields climbed to 4-year highs under the weight of downbeat economic data even as Central Bank of Nigeria (CBN) tightened monetary policy. Yet, opportunities abounded for few investors who cherry-picked within Nigeria’s cheap equity valuations and attractive entry points at the treasury markets. That said, expected upside at the equity space was not for the near term as investors concerned themselves with the country’s economic deterioration and implied pass-through to company earnings. Sentiment for equities was further worsened by foreign apathy on account of FX illiquidity and local investors’ attraction to higher risk-free rates which endeared them to the bond market. In a word, a confluence of bad news, capital losses and uncertainty ushered in panic in the streets. Investors had to ask themselves, is this stock market decline the beginning of something worse? Should we all sell and seek safety? Market was buying high and selling low, almost everyone was losing money in stocks. Unfortunately, when it comes to stock investing, going along with the crowd—buying when the market is up and selling when the market is down—can lead to costly mistakes. A better strategy during the turbulent times, when many are turning their backs on stocks, is to leverage on cheap equity investment valuations —a virtue seen only by a few at the time.

Study the past to define the future

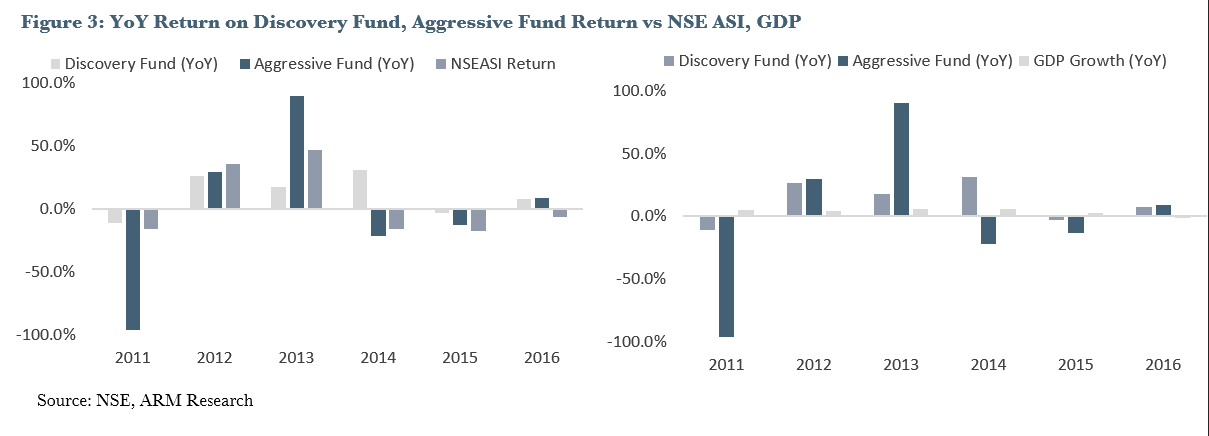

On the strength of historical data, equities market can be considered ‘the king of good times’. This is because the market does not only anticipate good times well ahead but also tends to rise (faster) as the economy recovers. Put simply, the stock market mirrors expectations about the economy well ahead of time in such a fashion that allows active and calculative investors make capital gains to increase their overall net worth.

In Nigeria, for instance, the stock market performance has been firmly correlated with crude oil price expectations, external reserve, and exchange rate. Pointedly, with crude oil exports representing circa. 70% and 90% of fiscal and export revenues respectively, it is not surprising the level of correlation expected between the economy and crude oil price or production shocks. Elsewhere, foreign inflows into equity are also determined by future expectations about external reserve and overall exchange rate stability as foreigners concern themselves with relative ease of entry and exit.

So far, signs of economic improvements has guided our view that Nigeria will exit recession this year. The OPEC-led production cut has also raised crude prices globally to ~$52.5/barrel (vs 2016 average of $45.1/barrel). On the domestic production front, contraction in crude output have sizably shrank following improved government conciliation and an increase in government amnesty provision. This is even as force majeure on the nation’s largest export terminal (Trans Forcados) was lifted in May. The foregoing has thus driven improved revenue picture for the FG with expected rise in dollar influx expected to sustain FX liquidity in the near term. On the back of these, the equities market has rallied 22.72% YTD with more prospect for further upside.

Wouldn’t you rather Invest now?

Before you start here, always remember stock prices are all about future earnings. Thus, with bullish economic and financial performance almost upon us, what the investment pros must be pricing in should be much rosier. Therefore, maximizing gains in the stock market requires looking past what’s about to happen and taking position in the market based on expectations of future performance. Earnings are about to come back into focus as second quarter reporting season gets set to kick off. Expectations are elevated. Investors may be hoping for more of a speed boat look to economic growth, but we believe that pontoon speed, while not exciting, is likely to be more beneficial to keeping the bull market going.

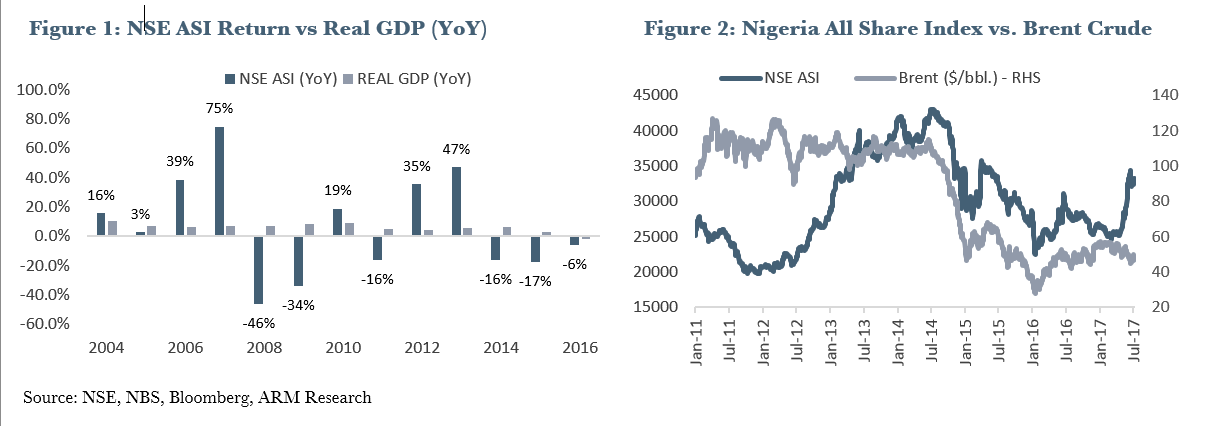

At ARM, we continue to build as well as prune our list of stocks. We pay specific attention to those with solid fundamentals or those that are unfairly being dragged down by the rest of the market—a case of “throwing the baby out with the bathwater.” These dislocations become widespread as many investors choose to flee or sell low during a correction rather than focus on the subsequent recovery. Having applied our framework, we stuck with our portfolio tilt towards stocks and we were net buyers of stocks in 2016 and, testament to our diligence, our funds benefited from the market rebound. Specifically, there is a strong correlation between the stock market and our Aggressive fund, due to its higher equity allocation (80-100%). The equity fund has constantly outperformed the market during periods of recovery or rebound.