IMF reaches Staff Level Agreement on the First Review of the Extended Credit Facility

On Friday 6th October 2023, the IMF staff and the Ghanaian authorities reached a staff-level agreement on economic policies and reforms to conclude the first review of the 36-month ECF-supported program.

We may recall that on May 17th, 2023, the IMF executive board approved an SDR2.24bn (c. USD3bn) 36-month Extended Credit Facility (ECF) for Ghana. Following the approval, the funds were to be released in batches, semi-annually.

Ghana has been faced with economic crisis and a heavy debt burden, supported by a combination of pre-existing vulnerabilities and external shocks. These led to its currency devaluation, declining external reserves, slower GDP growth, and high inflation.

According to the press release, an International Monetary Fund (IMF) staff team, led by Mr. Stéphane Roudet, Mission Chief for Ghana, held meetings in Accra from September 25 to October 6, 2023, to discuss progress on reforms and the authorities’ policy priorities in the context of the first review of Ghana’s three-year program under the Extended Credit Facility.

At the end of the mission, the following points were agreed:

1. IMF staff and the Ghanaian authorities have reached staff-level agreement on economic policies and reforms to conclude the first review of the 36-month ECF-supported program.

2. Ghana will have access to about USD600 million in financing once the review is approved by IMF Management and formally completed by the IMF Executive Board.

3. The authorities’ strong policy and reform commitment under the program is bearing fruit, and signs of economic stabilization are emerging.

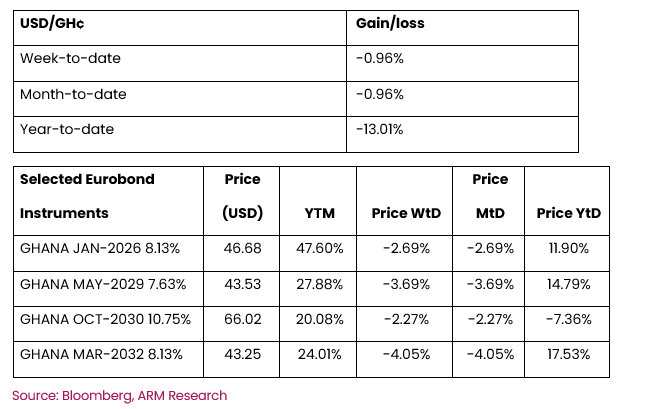

As of 6th October 2023, the Ghanian Cedi shed 0.96% week-to-date, closing at GH¢11.6775/USD as at 2pm. Likewise, Ghana’s Eurobond instrument also declined this week as highlighted below.

We expect Ghana’s Eurobond prices to continue its decline in the following week.

Eurobond prices and YTM are as of 6th October 2023 at 2.30pm

YTM – Yield to Maturity, WtD – Week-to-date, MtD – Month-to-date, YtD – Year-to-date

Click link for the press release.