Daily Market Update (Equities)

Today, the Nigerian equities made a negative momentum with the NGX All-Share Index (ASI) declining by 0.09% to settle at 96,715.04 points. Consequently, the market’s year-to-date (YtD) returns increased to 29.34% compared to 29.46% Yesterday.

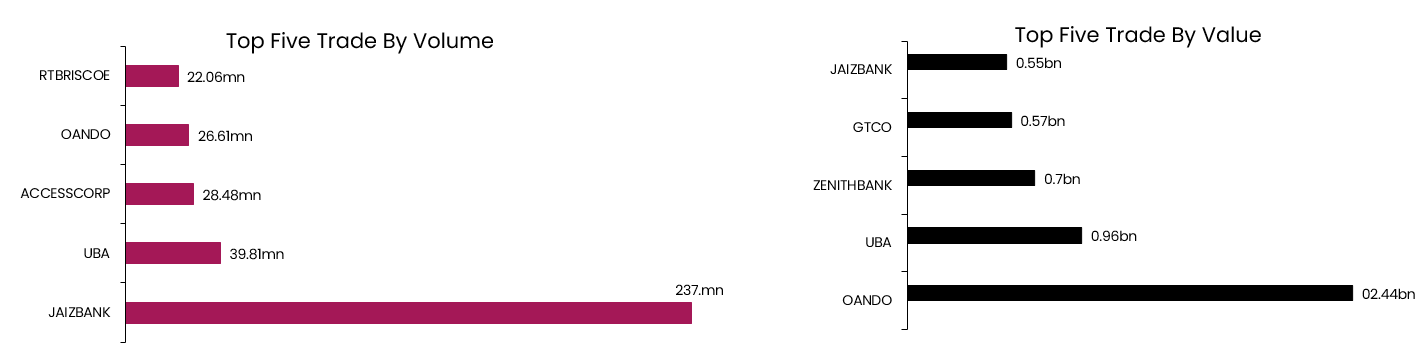

Today, the total volume increased by 47.72% to 600.04mn units, while the total value traded decreased by 33.86% to 8.81bn. JAIZBANK made its top position in volume traded while OANDO made it top position in value traded.

Top gainers today were CAVERTON, REDSTAREX and BERGER. On the other hand, CWG, NNFM and ACADEMY topped the losers’ chart.

Daily Market Update (Fixed Income)

Today, the NT-bills market ended on a positive note, as the average yield decreased by 0,03% to settle at 20.00%. Similarly, the FGN Bond market closed positive as the average yield decreased by 0.01% to settle at 18.73%. Overall, the Naira fixed income market closed positive as the average yield increased by 0.02% to settle at 19.36%.