Daily Market Update (Equities)

Today, the Nigerian equities made a negative momentum with the NGX All-Share Index (ASI) declining by 0.24% to settle at 96,204.84 points. Consequently, the market’s year-to-date (YtD) returns declined to 28.66% compared to 28.97% Friday.

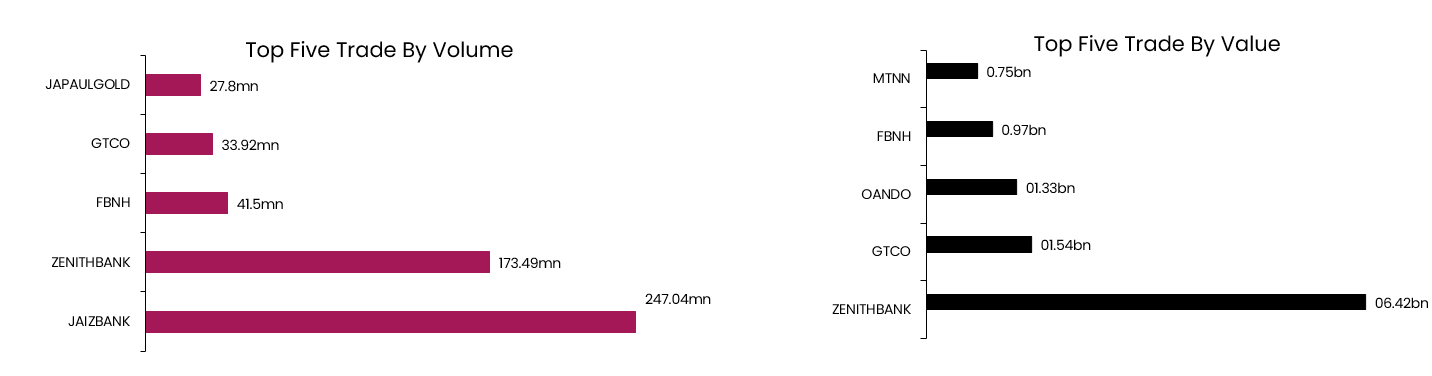

Today, the total volume and value traded increased by 97.29% to 774.38mn units and 21.82% to 14.65bn. JAIZBANK made its top position in volume traded while ZENITHBANK made it top position in value traded.

Top gainers today were ETERNA, OANDO and FTNCOCOA. On the other hand, JBERGER, UPL and CUTIX topped the losers’ chart.

Daily Market Update (Fixed Income)

Today, the NT-bills market ended on a negative note, as the average yield increased by 0.35% to settle at 20.01%. Similarly, the FGN Bond market closed negative as the average yield increased by 0.03% to settle at 18.72%. This follows sell-offs in the MAR-2025, JAN-2026, JUN-2033 and FEB-2034 instrument. Overall, the Naira fixed income market closed negative as the average yield increased by 0.19% to settle at 19.37%.