Today, the Nigerian Equities market closed on a positive note, as the All-Share Index (ASI) increased by 0.30% to 99,966.28 points. Consequently, the market year-to-date (YtD) returns rose to 33.69% from last Friday’s 33.30% YtD. This increase was driven by gains in CUTIX, IKEJAHOTEL and ROYALEX offsetting losses in CHELLARAM, CONRERST and LINKASSURE

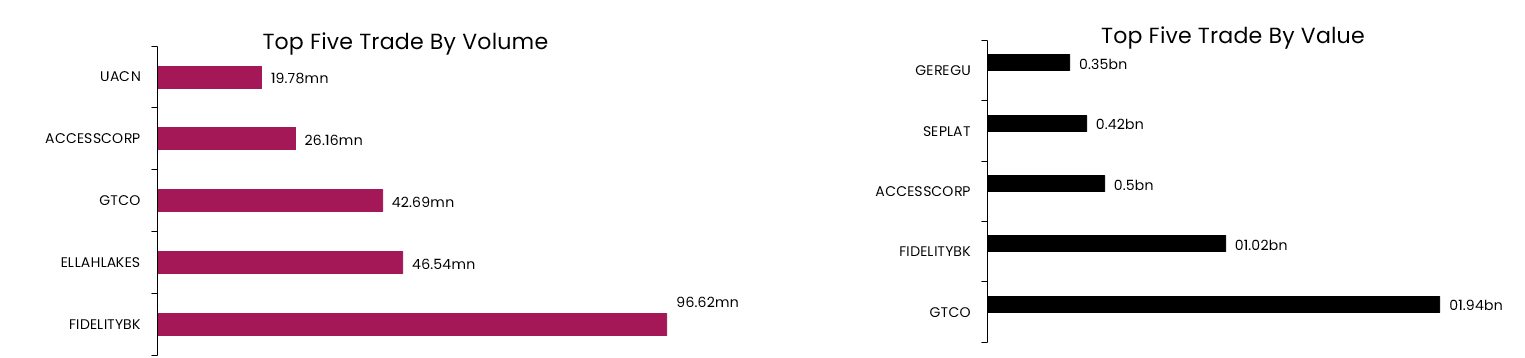

Today, total volume traded declined by 13.89% to 362.43mn units, while total value traded increased by 8.02% to NGN7.37bn respectively. GTCO traded the highest in terms of both Volume and Value.

The top gainers for today were CUTIX, IKEJAHOTEL and ROYALEX, while the top losers were CHALARAM, ABBEYBDS and JAIZBANK.

The top gainers for today were CUTIX, IKEJAHOTEL and ROYALEX, while the top losers were CHALARAM, ABBEYBDS and JAIZBANK.

Daily Market Update (Fixed Income)

• Today, the NT-bills secondary market ended on a bullish note, as the average yield declined by 3bps to settle at 23.30%. This was driven by buying interest in the long and short tenor bills. Conversely, the FGN bond market closed bearish as the average yield rose by 3bps to settle at 19.29%. This is on the back of selloffs in the Mar-2025 instrument. Overall, the Naira fixed income market closed flat as the average yield remaining unchanged at 21.14%.