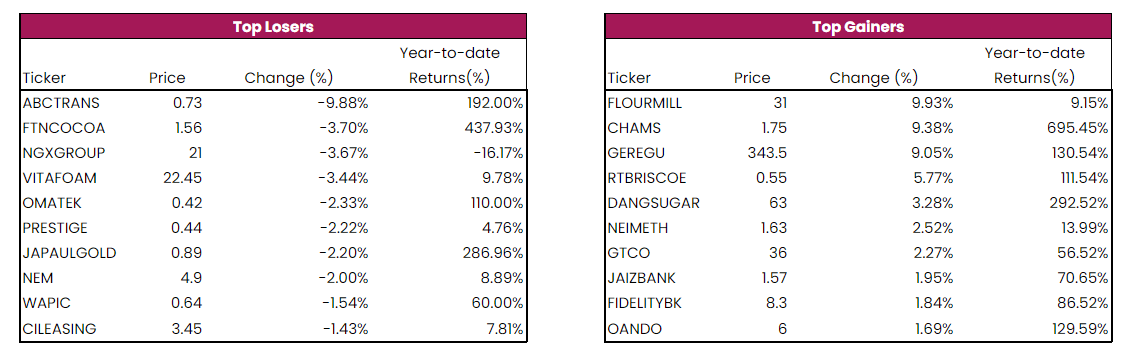

Today, the Nigerian equities market closed on a positive note as the bench mark index increased 0.51% to close at 67,217.77 points. Consequently, its Year-to-Date return printed at 31.15% (Yesterday: 30.49%). The strong performance was primarily driven by buying interest in Flour Mills, Chams, and Geregu offsetting the losses in ABC Tran, FTN Cocoa, and NGX Group .

Today, Chams traded the highest in terms of Volume while Fidelity Bank traded the highest in terms of Value. Total Volume and Value traded for today settled at NGN319.90mn and NGN6,330.15bn respectively.

Today, BUA Cement, Transitional Corp of Nigeria and Union Bank of Nigeria PLC topped the gainers’ chart, while Guaranty Trust Holding Co PLC, Oando PLC and Zenith Bank topped the losers’ chart.

Daily Fixed Income Market Update

Today, the NT-bills secondary market closed on a bullish note as average yield declined by 4bps to settle at 6.88%. This followed buying interest on the long tenor bills. However, the FGN bond market closed flat as average yield remained constant at 14.44%, following a mixed trading session. Overall, the Naira Fixed income market closed bullish as average yield declined by 2bps to settle at at 10.66%.