Daily Market Update (Equities)

Today, the Nigerian Equities market reverted from its upward trajectory, with the All-Share Index (ASI) declining by 0.40% to 99,311.54 points. Therefore, the market year-to-date (YtD) returns fell to 32.82% from yesterday’s 33.34% YtD. This declined was driven by losses in FBN, NESTLE and ZENITH offsetting the gains in WAPCO, TRANSCOR and FIDELITYBK.

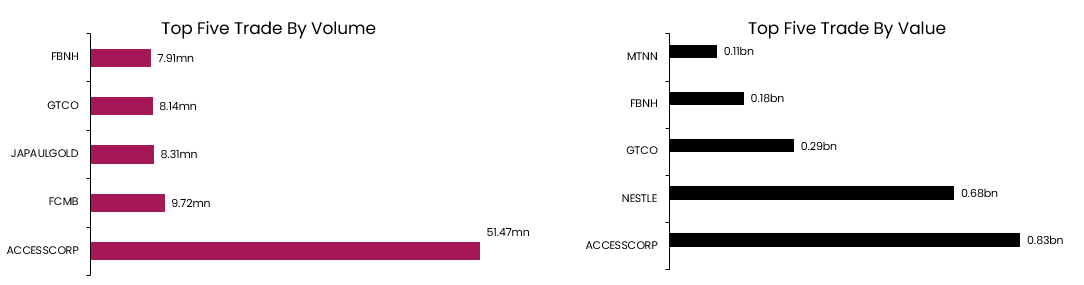

However, market activity was positive as both Total volume and value traded increased significantly by 87.34% and 47.95% each to 574.43mn units and NGN7.84bn respectively. ACCESSCORP traded the highest in terms of both Volume and Value.

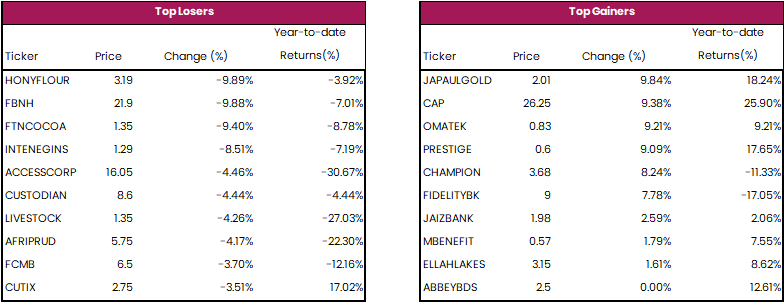

The top gainers for today were JAPAULGOLD, CAP and OMATEK, while the top losers were HONYFLOUR, FBNH and FTNCOCOA.

Daily Market Update (Fixed Income)

Today, the Nigerian Treasury bills secondary market closed on a positive note, as the average yield fell by 0.07% to 25.08%. Similarly, the FGN bond market witnessed positive sentiment as the average yield declined by 0.07% to 18.97%. This was propelled by buying interest in all segments of the yield curve, particularly in the JAN-2026 (-0.72%), MAR-2026 (-0.56%), 20-MAR-2027 (-0.58%) and APR-2032 (-0.16%) instruments. Overall, the Naira fixed income market concluded positive with the average yield down by 0.07% to 22.03%.