Daily Market Update (Equities)

The Nigerian equities market started the week on a positive note as the NGX All-Share Index (NGX ASI) rose by 0.17% to settle at 99,706.40 points. Consequently, the year-to-date (YtD) returns went up to 33.34% (vs. Yesterday: 33.12% YtD). The gains in GTCO, ZENITH and TRANSCOR offsetting losses in STANBIC, FIDELITY and FCMB.

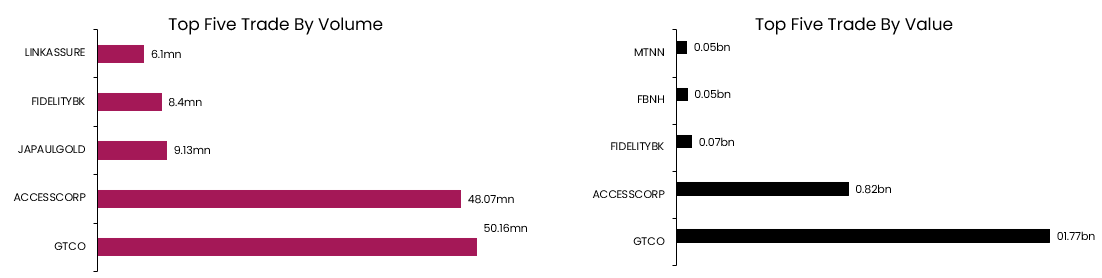

The Total volume traded increased by 18.91% to 306.62mn units, while the Total value traded fell by 1.81% to NGN5.30bn respectively. GTCO traded the highest in terms of both Volume and Value.

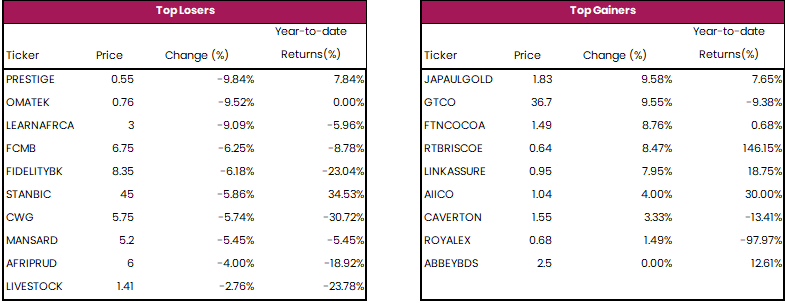

Today, JAPAULGOLD, GTCO and FTNCOCOA led the gainers chart, while PRESTIGE, OMATEK and LEARNAFRCA led the laggards.

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market witnessed mixed sentiment albeit closed on a positive note, with the average yield dipping by 0.03% to 25.15%. Conversely, the FGN bond market rose slightly by 1bp to 19.05%. This was driven by sell-offs in the short and mid-term of the yield curve. Overall, the Naira fixed income market concluded on a positive note with the average yield down by 0.01% to 22.10%.