Daily Market Update (Equities)

Today, the Nigerian equities market reverted to negative territory, declining by 0.12% to 101,239.10 points. This pushed market’s year-to-date (YtD) returns down to 35.39% (vs. Yesterday: 35.56% YtD). Losses in Stanbic IBTC, ACCESSCCORP, and Transnational Corp outweighed gains in GTCO, FBNH, and FIDELITYBANK, contributing to the negative performance.

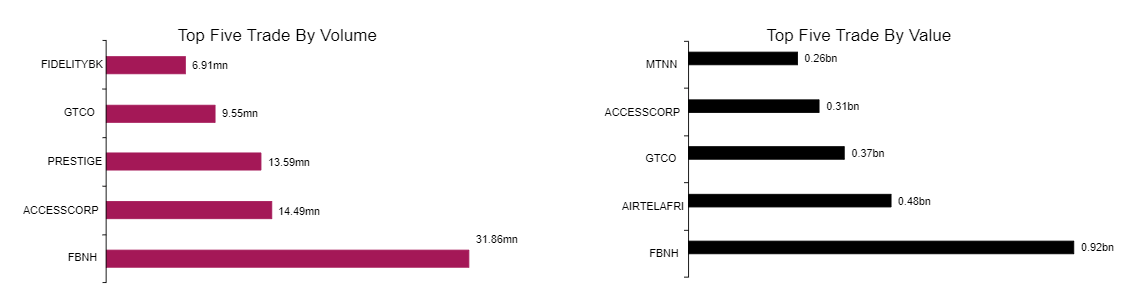

Market sentiment was further dampened by declines in both total volume (-14.21% to 253mn units) and value (-23.33% to NGN4.94bn). FBNH remained the top performer in terms of both volume and value for the second consecutive trading day.

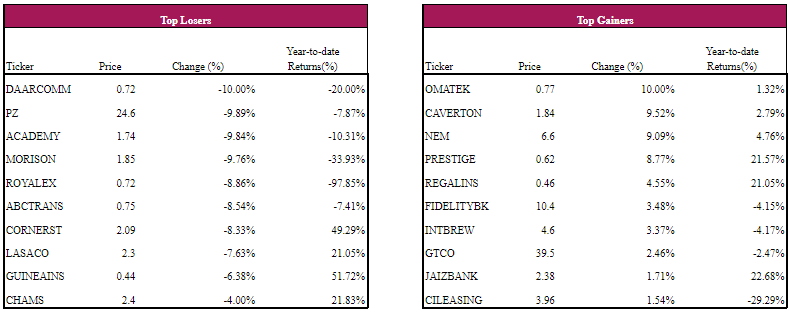

DAARCOMM, PZ and ACADEMY recorded the highest losses today, while OMATEX, CAVERTON and NEM were the highest gainers.

Daily Market Update (Fixed Income)

Today, average yield at the NT-bills secondary market surged by 1.28% to settle at 16.71%, pushing the market to a negative close. Likewise, the secondary FGN Bond market saw negative sentiment as the average yield in the market went up by 0.41% to 16.80%. Overall, the Naira Fixed Income market closed negative as the average yield increased by 0.85% to settle at 16.75%.