Daily Market Update (Equities)

The Nigerian equities market snapped from a three-day losing streak, with the NGX All Share Index (ASI) rising by 0.13% to close at 104,387.47 points. As a result, the market’s year-to-date (YtD) return went up to 39.60%, compared to yesterday’s 39.43%. Gains recorded in heavyweight stocks like BUACEM, TRANSCORP, and ZENITH offset losses in MTNN, FBNH, and LAFARGE.

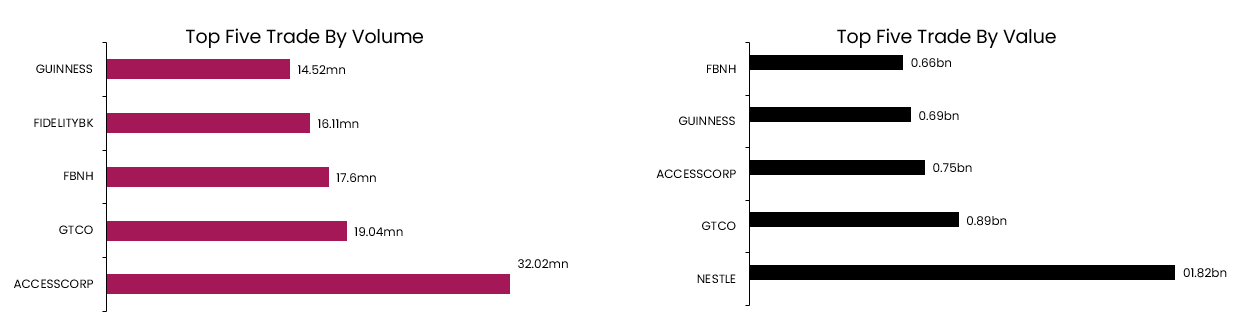

The total volume and value traded surged by 12.78% and 35.74% respectively, to settle at 336.82mn units and NGN9.29bn. ACCESSCORP traded the highest in terms of volume and Nestle traded the highest in terms of value.

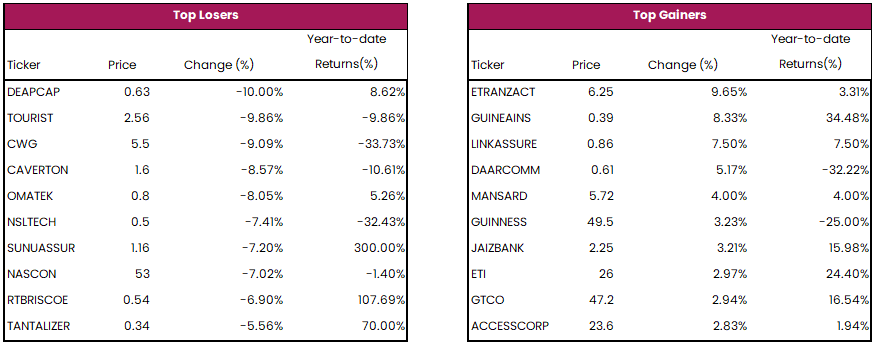

Today’s top gainers were ETRANZACT, GUINEAINS, and LINKASSURE. Conversely, the top losers were DEAPCAP, TOURIST, and CWG.

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market witnessed mixed trading session, albeit closed flat at 17.33%. Conversely, the FGN bond market closed positive as the average yield fell by 0.24% to settle at 18.70%, this decline was driven by buying interest in the mid and long ends of the yield curve, specifically in the FEB-2034 (-2.84%) and JUN-2053 (-0.50%) instruments. Overall, the Naira fixed income market closed on a positive note as the average yield dipped by 0.12% to 18.02%.