Daily Market Update (Equities)

The Nigerian equities market extended its losing streak for a third consecutive day. The NGX All Share Index (ASI) dipped by 0.28% to close at 104,256.81 points. This decline pushed the year-to-date (YtD) return down to 39.43%, compared to yesterday’s 39.83%.

Selling pressure dominated the market, with losses recorded in heavyweight stocks like FBNH, TRANSCOHOT, and JBERGER. Gains were seen in UBA, INTBREW, and FIDELITYBANK, but they were unable to offset the broader market weakness.

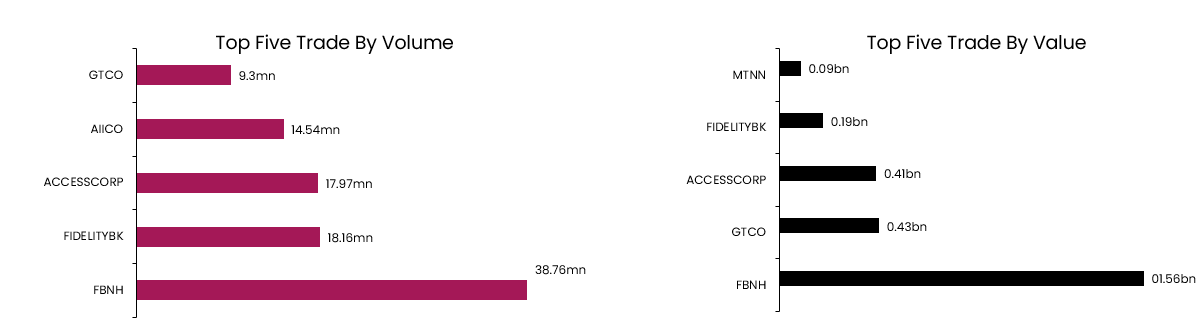

Trading activity remained subdued. The total volume and value traded declined by 2.73% and 9.92% respectively, settling at 298.65mn units and NGN6.84bn. Notably, FBNH maintained its position as the most traded stock by both volume and value for the second consecutive day.

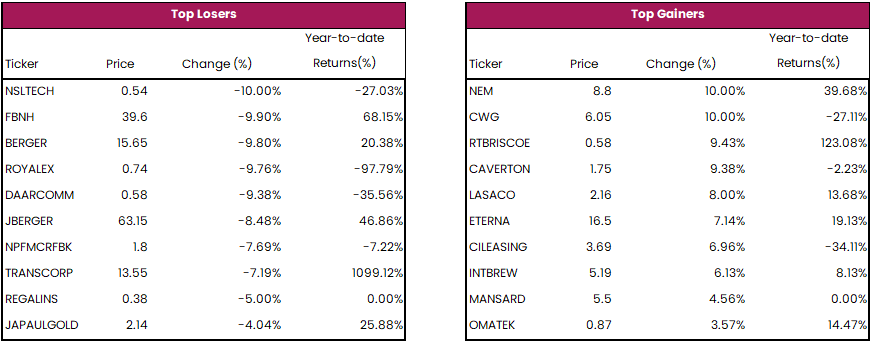

The top losers today were NSLTECH, FBNH, and BERGER. Conversely, the top gainers were NEM, CWG, and RTBRISCOE.

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market extended its positive trend as the average yield declined by 1.15%, to settle at 17.33%. Conversely, the FGN bond market witnessed a negative sentiment, pushing the average yield higher by 0.35%, to settle at 18.94%, this was on the back of selloffs across all segments of the yield curve, notably in the NOV-2028 (+0.98%), APR-2029 (+1.00%) and APR-2032 (+1.16%) instruments. Overall, the Naira fixed income market concluded on a positive note with the average yield dipping by 0.40 to 18.14%.