Daily Market Update (Equities)

Following a further negative run in the Nigerian equities market, the NGX All-Share Index (ASI) fell by 1.36% to settle at 95,779.79 points. Consequently, the market’s year-to-date (YtD) returns decreased to 28.09% compared to 29.86% on Friday.

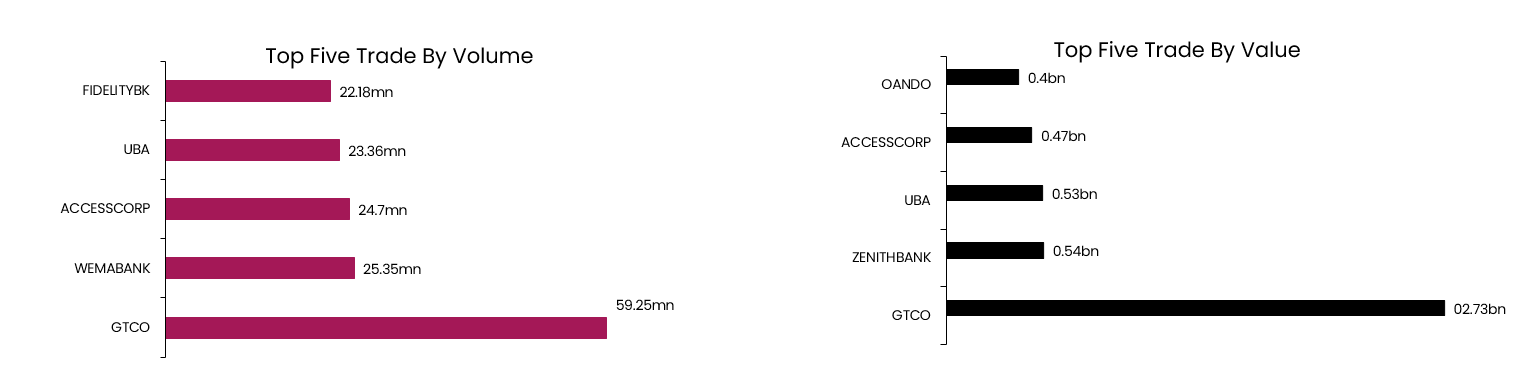

Today, market activity made a positive performance, as total volume and value traded increased by 916.19% and 2.47% respectively to 3.55bn units and NGN7.65bn. GTCO maintained its top position in both value and Volume traded for today.

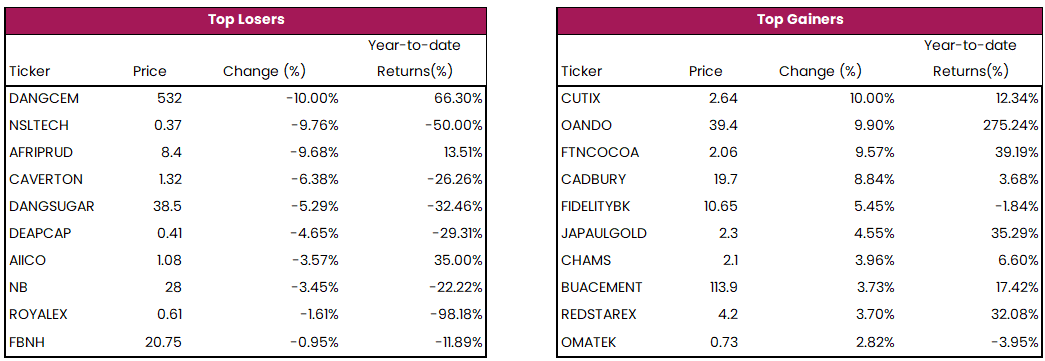

Top gainers today were CUTIX, OANDO and FTNCOCOA. On the other hand, DANGCEM, NSLTECH and AFRIPUD topped the losers’ chart.

Top gainers today were CUTIX, OANDO and FTNCOCOA. On the other hand, DANGCEM, NSLTECH and AFRIPUD topped the losers’ chart.

Daily Market Update (Fixed Income)

Today, the positive momentum in the Nigerian fixed income market persisted. The average yield in the NT-bills market dipped by 0.15% to close at 25.31%. This is following buying interest across all tenors. Similarly, the FGN bond market closed on a positive note, as the average yield declined by 0.22% to settle at 19.71%. This was driven by buying interest across the yield curve. Consequently, the overall Naira fixed income market experienced a positive close, as the average yield dropped by 0.19% to settle at 22.51%.