Daily Market Update (Equities)

The Nigerian equities market extended its downtrend today, with the NGX All Share Index (ASI) falling by 0.11% to close at 104,553.31 points. This decline pushed the year-to-date (YtD) return down to 39.83%, compared to yesterday’s 39.97%. Losses in heavyweight stocks like MTNN, ZENITH, and GTCO outweighed gains in FBNH, LAFARGE, and UBA.

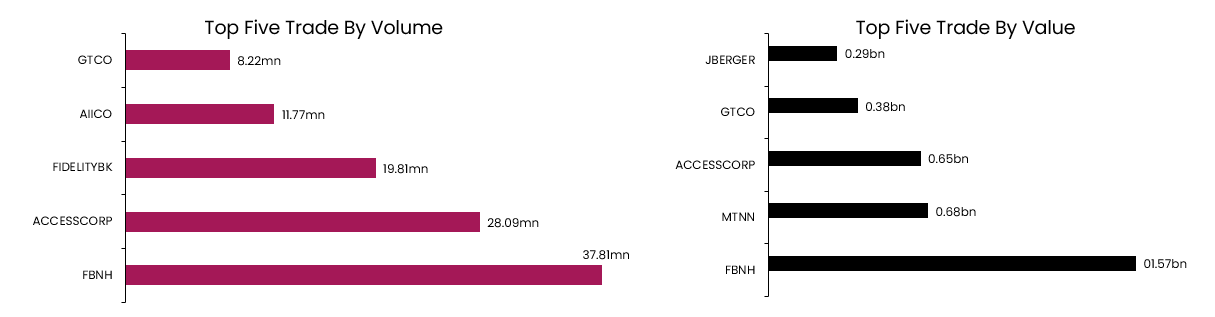

Despite the decline in value, total volume traded increased by 6.82% to 307.95mn units. However, the total value traded dropped by 29.69% to NGN7.59bn. FBNH traded the highest in terms of both volume and value.

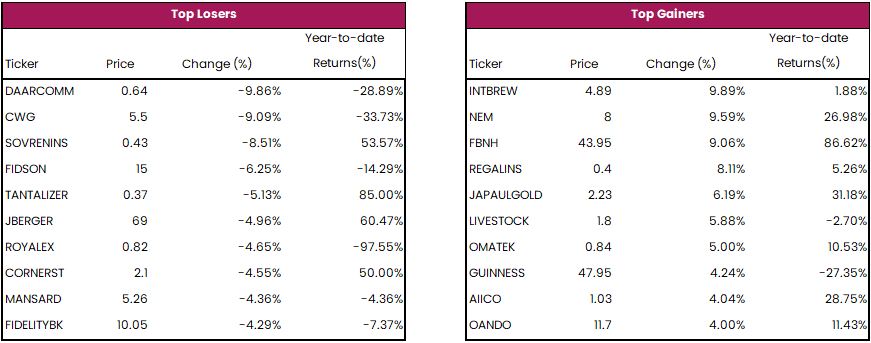

The top decliners today were DAARCOMM, CWG, and SOVRENINS. Conversely, the top advancers were INTBREW, NEM, and FBNH.

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market closed on a positive note as the average yield went down by 0.06%, to settle at 19.48%. Conversely, the FGN bond market experienced a sell-off, pushing the average yield higher by 0.20%, to settle at 18.60%. This rise in bond yields was driven by selling pressure in the short- and mid-tenor segments of the curve, particularly in the JUL-2030 (+1.02%), FEB-2031 (+1.50%), and FEB-2034 (+1.36%) instruments. Overall, the Naira fixed income market concluded on a negative note as the average yield rose by 0.07% to 18.54%.