Daily Market Update (Equities)

The Nigerian equities market closed lower today, with the NGX All Share Index (ASI) dipping by 0.33% to settle at 101,707.70 points. This decline pushed the year-to-date (YtD) returns down to 36.02%, compared to yesterday’s 36.47%.

The market’s negative performance was primarily driven by losses in key banking stocks ZENITHBANK, UBA, and FBNH, which outweighed gains in DANGSUGAR, UNICAP, and CORNERSTONE.

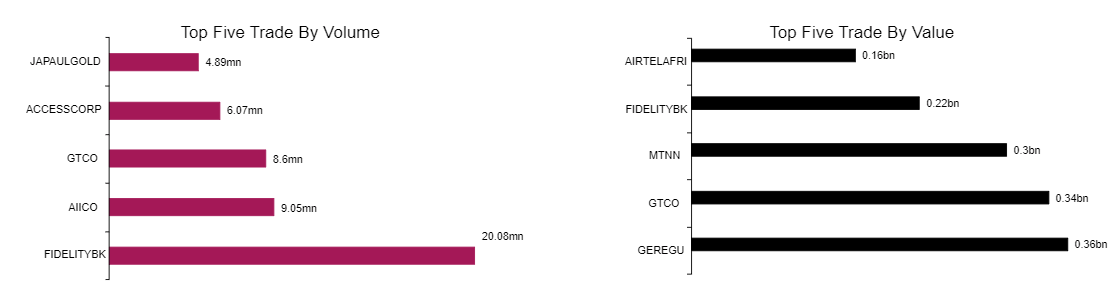

The Total Volume increased by 8.56% to 263.19mn units, while the Total Value traded continued its downward trajectory by 16.09% to NGN4.3bn. Today, FIDELITYBANK traded the highest in terms of Volume while GEREGU traded the highest in terms of Value.

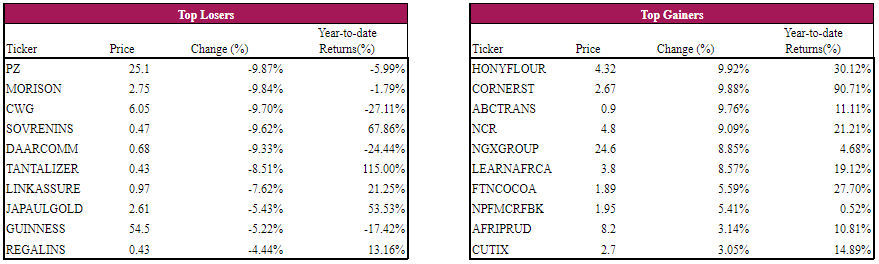

The top losers for today were PZ, MORISON and CWG while HONEYFLOUR, CORNERST and ABCTRANS led the gainers’ chart.

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market closed on a positive note with the average yield falling by 0.16% to 15.15%. Conversely, the FGN bond market closed negative with the average yield rising by 0.22% to settle at 15.76%, this was driven by significant selloffs, particularly in the JAN-2026 (+2.56%), APR-2032 (+1.05%) and JUL-2030 (+0.43%) instruments. Overall, the Naira Fixed Income market concluded on a negative note with the average yield up by 0.03% to 15.46%.