Daily Market Update (Equities)

The Nigerian equities market continued its downward trend for the fourth consecutive trading day this week. The NGX All Share Index dipped by 0.33%, closing at 99,468.90 points. This decline pushed the market’s year-to-date (YTD) return down to 33.03%, compared to 33.47% YTD yesterday. Losses in SEPLAT, TRANSCORP, and ACCESSCORP were the main drivers of the negative performance, outweighing gains recorded by AIRTELAFRI, UBA, and WAPCO.

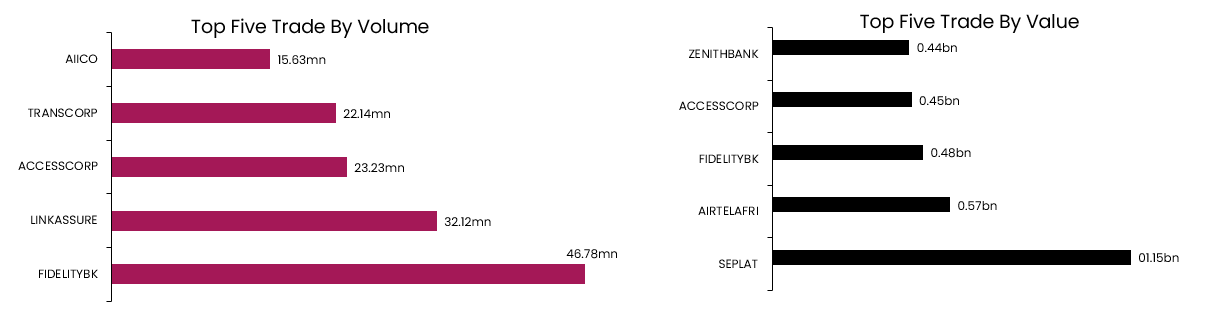

Market activity also saw a significant decline, with total volume and value traded dropping by 68.27% and 53.99% respectively, to 296.73mn units and NGN5.45bn. FIDELITYBK was the most traded by volume, while SEPLAT led in terms of value traded.

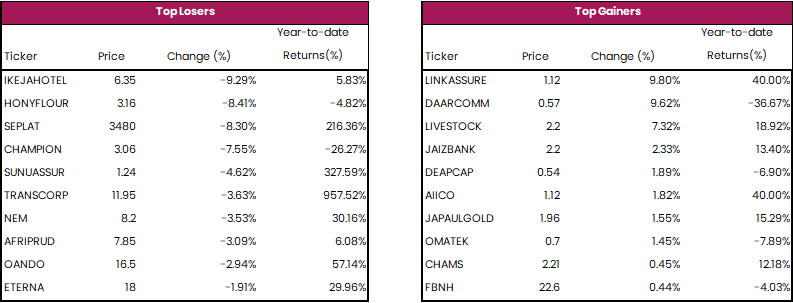

LINKASSURE, DAARCOMM and LIVESTOCK led the gainers, while IKEJAHOTEL, HONYFLOUR and SEPLAT led the laggards.

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market ended on a positive note as the average yield declined by 0.16% to settle at 23.30%. This was driven by buying interest across the tenors. However, the FGN bond market witnessed negative sentiment as the average yield rose by 0.03% to close at 18.98%. This is on the back of selloffs in the MAR-2025 (+0.01%) and JAN-2026 (+0.86%) instruments. Overall, the Naira fixed income market concluded on a positive note with the average yield down by 0.06% to 21.14%.