Daily Market Update (Equities)

The Nigerian equities market started the week on a positive note, as the NGX All Share Index (ASI) increased by 0.70% to settle at 102,044.84 points. As a result, the year-to-date (YtD) return went up to 36.47% compared to last Friday’s 35.52% YtD . The positive market sentiment was driven by gains in ZENITH, DANGSUGAR and UBA, offsetting the loses in FBNH, OANDO and UAC.

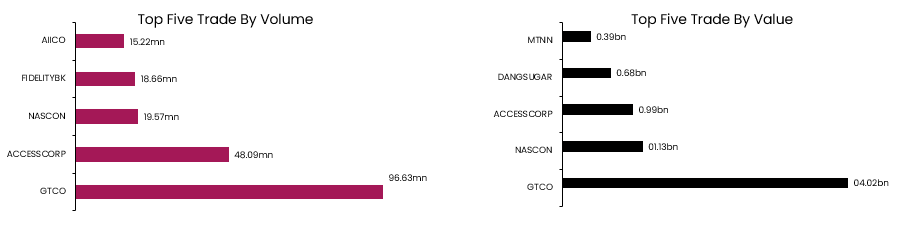

Similarly, the total Volume traded went up by 22.00% to NGN439.90mn, while the total value traded declined by 13.98% NGN 17.10bn units. GTC traded the highest in terms of both Volume and Value.

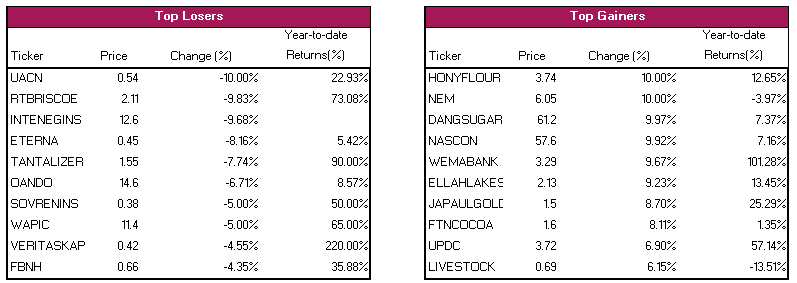

Today, HONEYFLOUR, NEM, and DANGSUGAR topped the gainers’ chart while UACN, RTBRISCOE and INTENEGINS led the gainers’ chart.

Today, HONEYFLOUR, NEM, and DANGSUGAR topped the gainers’ chart while UACN, RTBRISCOE and INTENEGINS led the gainers’ chart.

Daily Market Update (Fixed Income)

Daily Market Update (Fixed Income)

Today, the NT-bill secondary market closed on a bearish note, as the average yield increased by 2bps to settle at 18.82%. Similarly, the FGN bond market closed negative as the average yield went up by 3bps to settle at 18.04%. This is on the back of significant sell-offs across all ends of the yield curve. Overall, the Naira Fixed Income market ended on a bearish note as the average yield increased by 3bps to settle at 18.43%.