Daily Market Update (Equities)

The Nigerian equities market opened the week on a negative note, with the NGX All-Share Index (NGX ASI) dipping 0.33% to close at 103,096.85 points. Gains in STERLING, TRANSCORP, AIICO, and OANDO were offset by losses in GTCO, FBNH, UBA, and ZENITH. Consequently, the market’s year-to-date (YTD) returns fell slightly to 37.88%, down from Friday’s closing of 38.33%.

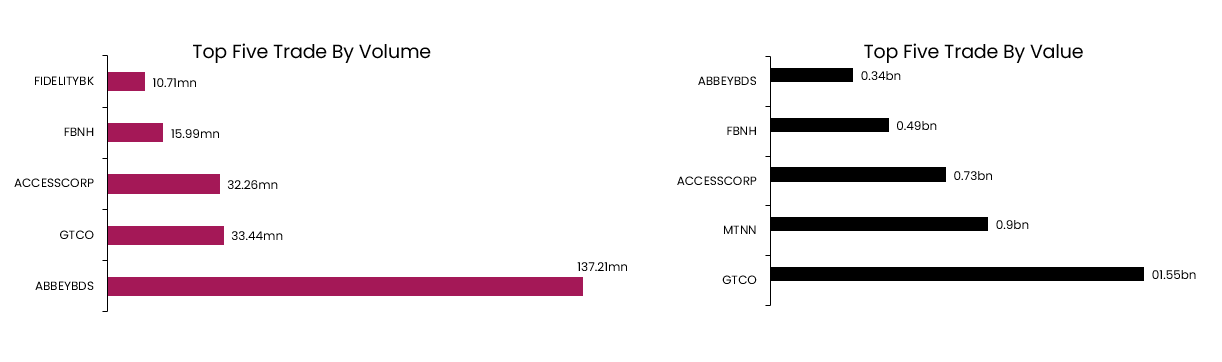

Trading activity also saw a significant decline today. Total volume and value traded dropped by 89.03% and 82.80% respectively, settling at 245.86mn units and NGN3.22bn. ABBEYBDS was the most traded stock by volume, while GTCO led in terms of the value traded.

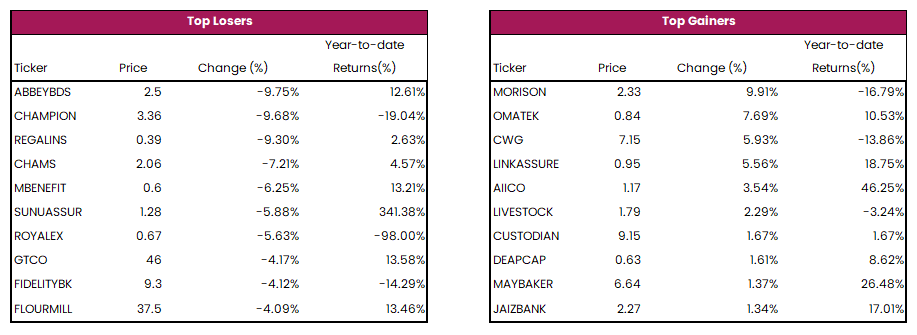

Top gainers for the day were MORISON, OMATEK and CWG, while the top losers were ABBEYBDS, CHAMPION and REGALINS.

Daily Market Update (Fixed Income)

Today, the Nigerian Treasury bill (NT-bill) secondary market displayed muted activity, closing slightly positive. The average yield edged down by 0.01% to settle at 18.90%. Similarly, the FGN bond market experienced a positive session, with the average yield declining by 0.13% to 19.26%. This bullish sentiment was driven by buying interest across the yield curve, particularly in the FEB-2028 (-0.79%), JUL-2034 (-1.02%), and MAR-2035 (-1.15%) instruments. Reflecting these positive performances, the overall Naira fixed income market closed on a positive note, with the average yield decreasing by 0.07% to 19.08%.