Daily Market Update (Equities)

Today, the Nigerian equities market reversed course, shedding yesterday’s gains. The NGX All Share Index dipped 0.23% to close at 100,065.68 points. This decline pushed the year-to-date (YtD) return down to 33.82%, compared to 34.14% yesterday. This negative performance was driven by losses in MTNN, WAPCO and CHAMPION offsetting gains in ZENITH, FBNH and UBA.

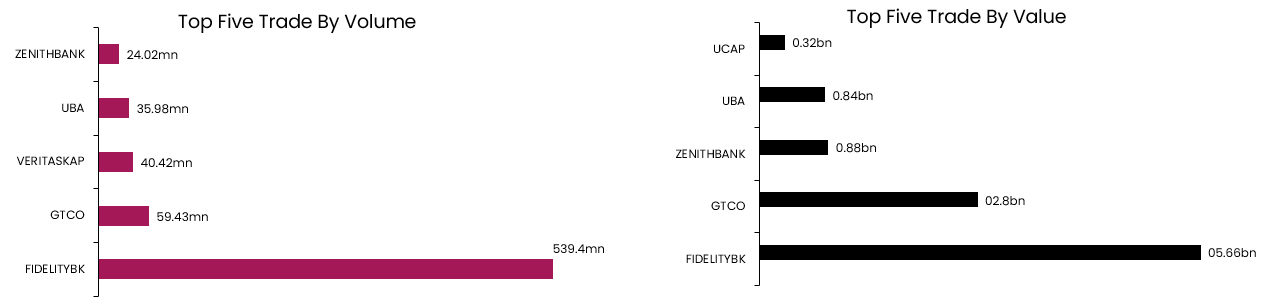

Despite the negative movement, trading activity saw a significant boost. The total volume and value traded surged by 152.36% and 164.30% each, reaching 863.57mn units and NGN12.56bn respectively. FIDELITYBK was the most actively traded stock by both volume and value.

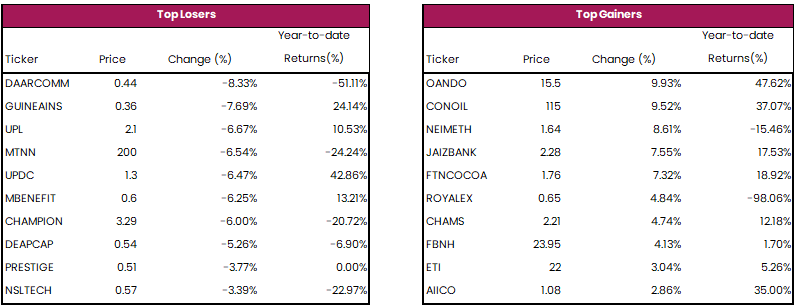

Today, OANDO, CONOIL and NEIMTH led the gainers, while DAARCOMM, GUINEAINS and UPL led to losers.

Daily Market Update (Fixed Income)

Today, the Nigerian Treasury bills (NT-bills) market witnessed negative sentiment as the average yield increased by 0.28% to close at 22.48%. This was driven by new issuance in the market. Likewise, the FGN bond market closed on a negative note as the average yield rose by 0.01% to settle at 18.76%. This is following selloffs on the short and long end of the yield curve. Overall, the Naira fixed income market concluded in the negative territory as the average yield climbed 0.14% to settle at 20.62%.