Daily Market Update (Equities)

The Nigerian Equities market started the week on a negative note, as the NGX All Share Index declined by -0.04% to settle at 100,020.83 points. This pushed the market’s year-to-date (YtD) returns up to 33.76% (vs. Friday: 33.81% YtD).

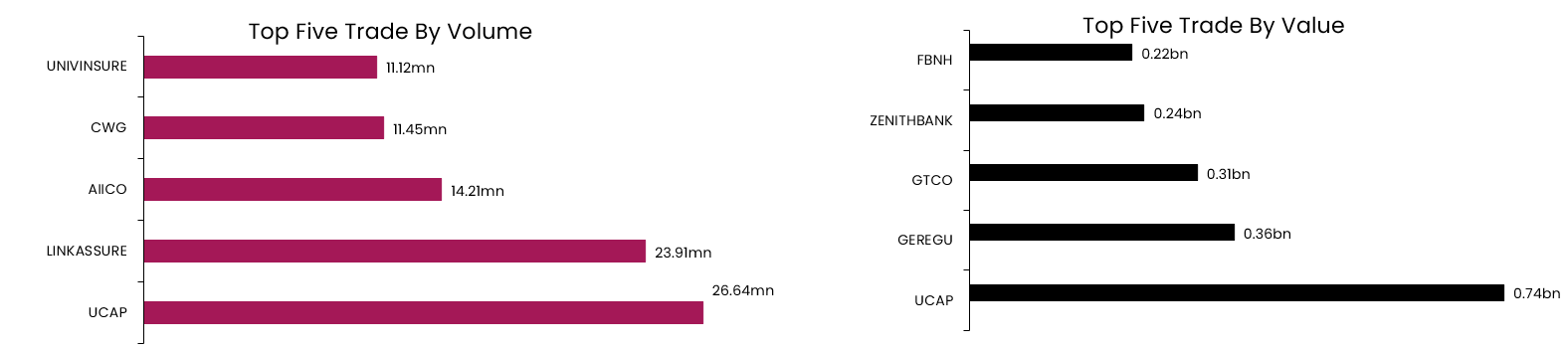

Today, total Volume and Value traded each decreased by 46.11% and 62.44% to 274.68mn units and NGN3,712.97bn respectively. UCAP led the charts in terms of both total Volume and Value traded for the day.

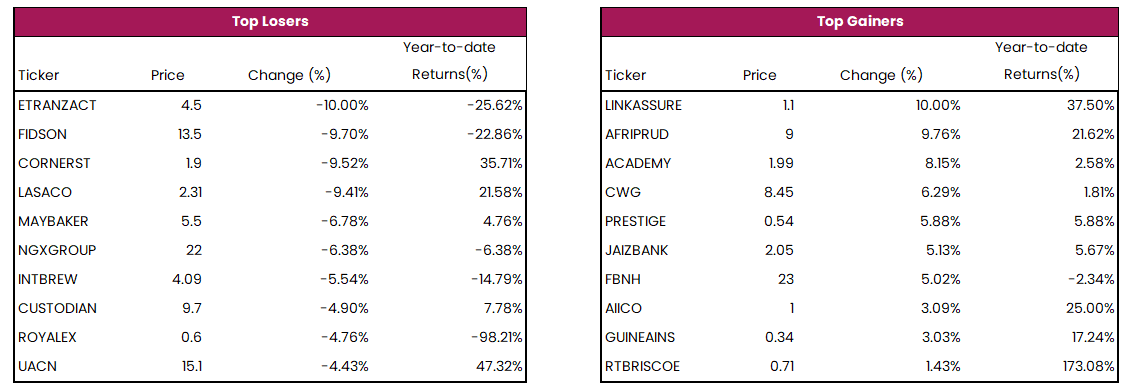

LINKASSURE, AFRIPRUD and ACADEMY gained the highest today, while ETRANZACT, FIDSON and CORNERST led the laggards.

LINKASSURE, AFRIPRUD and ACADEMY gained the highest today, while ETRANZACT, FIDSON and CORNERST led the laggards.

Daily Market Update (Fixed Income)

Daily Market Update (Fixed Income)

Today, the Nigerian Treasury bills market exhibited mixed sentiment, albeit closing positive, with the average yield down by 0.04% to 22.03%. This is following buying interest in the short-tenor bills. Conversely, the FGN bond market closed flat despite a mixed trading session, with the average yield at 18.75%. Overall, the Naira fixed income market ended on a positive note, with the average yield falling by 2bps to settle at 20.39%.