Daily Market Update (Equities)

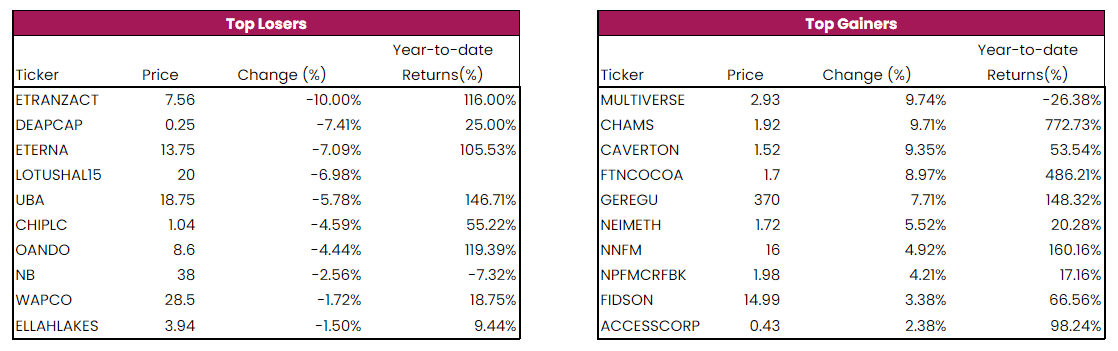

The Nigerian Equities market closed the week with a decline in performance as its benchmark index fell by 0.2% to 67,206.16 points. As a result, its year-to-date (YtD) returns decreased to 31.13% (vs. Yesterday’s YtD: 31.15%). The losses recorded in , ETRANZACT, DEAPCAP, and ETERNA offset the gains incurred in MULTIVERSE, CHAMS and CAVERTON.

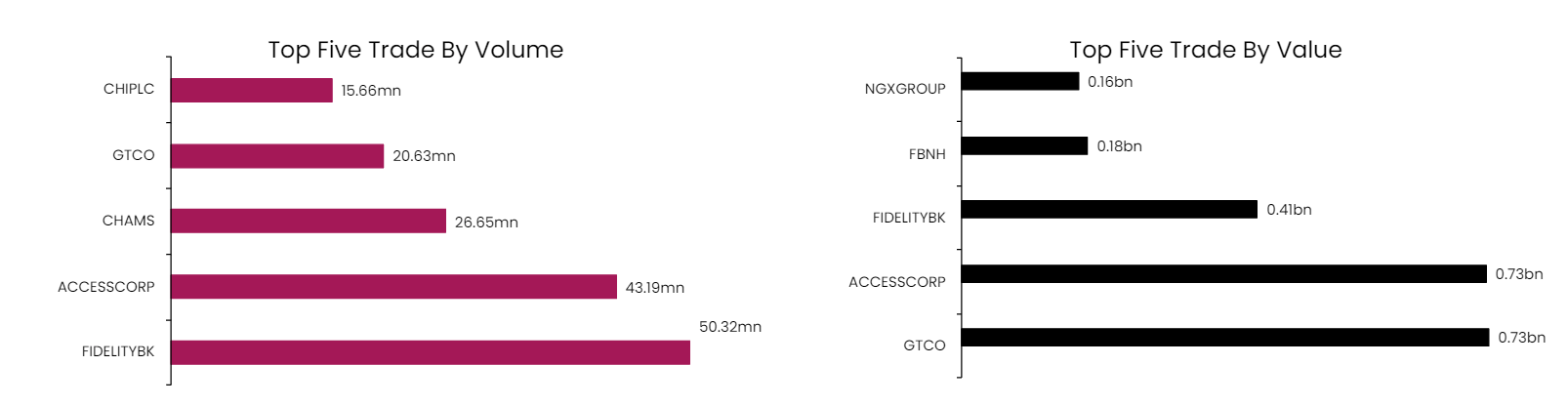

The Total Volume and Value traded for today are 15.66mn units and NGN0.16bn. CHIPLC traded the highest in terms of Value and NGXGROUP traded the highest in terms of Volume.

Today, SUNU ASSURANCE, ETRANZACT, AND DEAPCAPITAL topped the losers’ chart, while MULTIVERS, CHAMS and CAVERTON topped the gainers’ chart.

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market closed on a bearish note as average yield increased by 9bps to settle at 6.97%. This followed sell-offs on the mid-tenor bills. Similarly, the FGN bond market closed bearish as average yield went up by 2bps to settle at 14.46%. This is on the back of sell-offs in the short and long end of the curve. Overall, the Naira Fixed income market closed negative as average yield climbed by 5bps to settle at 10.72%.