Today, the Nigerian Equities market closed on a positive note, as the All-Share Index (ASI) increased by 0.10% to 100,075.59 points. Consequently, the market year-to-date (YtD) return rose to 33.84% from yesterday’s 33.30% YtD. This increase was driven by gains in ZENITH, UBA, and FBNH. offsetting losses in STANBICIBTC, TRANSCORP, and DANGSUGAR.

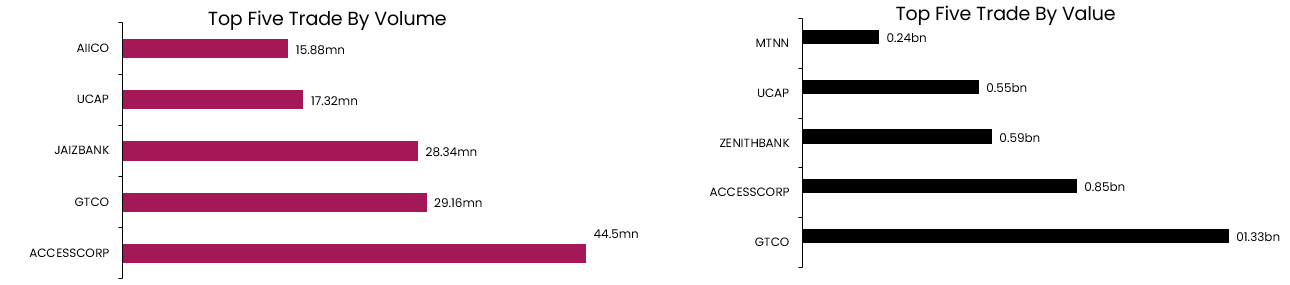

Today, total volume and value traded increased by 1.65% and 0.78% to NGN368.36mn and NGN7.42bn units respectively. GTCO traded the highest in terms of value, while ACCESCORP traded the highest in terms of volume.

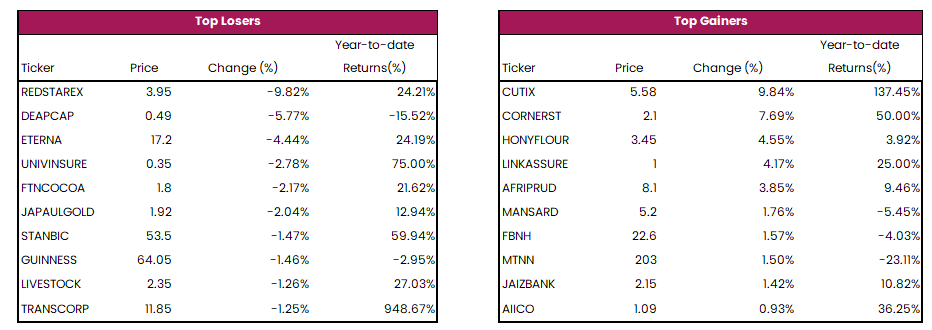

The top gainers for today were REDSTAREX, DEAPCAP, and ETERNA, while the top losers were CUTIX, CORNERST, and HONEYFLOUR.

Daily Market Update (Fixed Income)

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market ended on a bullish note, as the average yield declined by 2bps to settle at 23.28%. This was driven by buying interest in the mid and long tenor bills. Conversely, the FGN bond market closed flat as the average yield remained unchanged at 19.29%. Overall, the Naira fixed income market closed bullish as the average yield declined by 1bps to settle at 21.14%.