Daily Market Update (Equities)

The Nigerian stock market continued its downward trend, declining for the third (3rd) consecutive trading day, albeit at a slower pace by 0.01%. Market capitalization decreased by NGN5.72bn, bringing the year-to-date return to 30.36%, down from 30.38% YtD yesterday. The bearish sentiment was driven by UBA, FIDELITYBK, NB, and STERLING, which outweighed gains in OANDO, GTCO, GUINNESS, and ZENITH. High yields in the fixed income market likely contributed to the stock market’s losses.

Today, the Banking (-0.22%), Oil and Gas (-0.13%), and Consumer Goods (-0.05%) sectors declined, while the Industrial Goods and Insurance sectors closed flat.

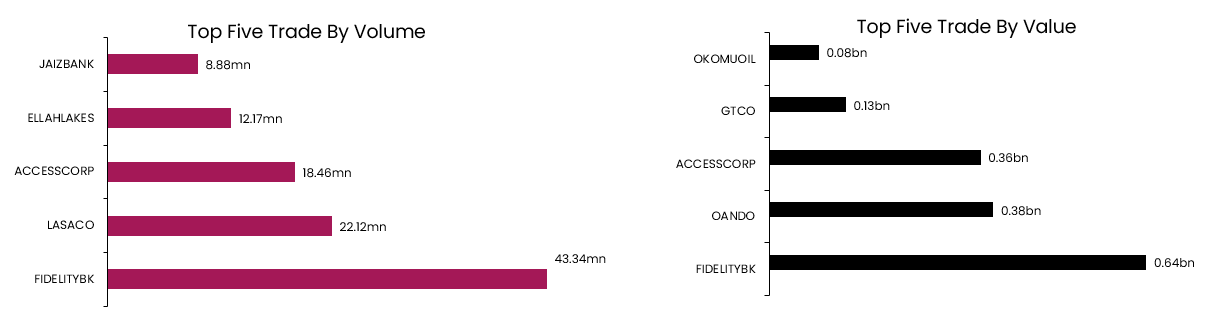

Trading activity decreased, as the total volume and value traded declined by 22.01% and 33.07% each to close at 277.75mn units and NGN4.65bn, respectively. For the second (2nd) consecutive trading day, FIDELITYBK traded the highest in terms of both volume and value.

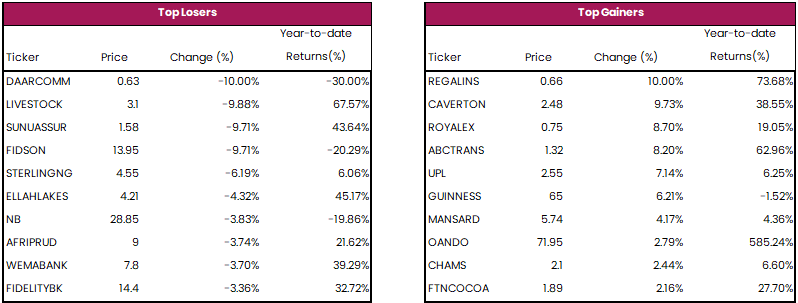

Today REGALINS, CAVERTON and ROYALEX led the gainers chart, while DAARCOMM, LIVESTOCK and SUNUASSUR led the laggards.

Daily Market Update (Fixed Income)

At the primary Nigerian Treasury bills (NT-bills) auction held yesterday, the CBN offered NGN81.90bn worth of treasury bills across the 91-day (NGN28.47bn), 182-day (NGN22.67bn) and 364-day (NGN30.76bn) bills. Demand at the auction was primarily skewed to the 374-day (NGN251.68bn) day bill. The average stop rate fell by 0.05% to 18.12% (vs.18.17% at the last auction), following a reduction in the rates offered for the 364-day bill (-0.14% to 19.86%). TheCBN sold the total amount offered.

At the secondary market, yields in the Nigerian Fixed income market treaded higher today. The average yields in the NT-bills market increased by 0.28% to close at 23.15%. This is following repricing in the NT-bills market following the auction. Conversely, average yields in the FGN bond market remained unchanged for the fourth (4th) consecutive trading day this week at 19.08%. Consequently, the overall Naira fixed income market closed on a negative note as the average yield rose by 0.14% to settle at 21.12%.