Daily Market Update (Equities)

Today, the Nigerian equities market continued its downward trend, albeit at a slow pace as the NGX All Share Index fell by 0.004% to close at 99,802.08 points. Consequently, the Market year-to-date (YtD) return declined to 33.47%, compared to yesterday’s 33.48% YtD. This performance was driven by losses in ZENITH, GTCO and UBA, offsetting gains in DANGSUGAR, TRANSCORP AND FIDELITYBNK

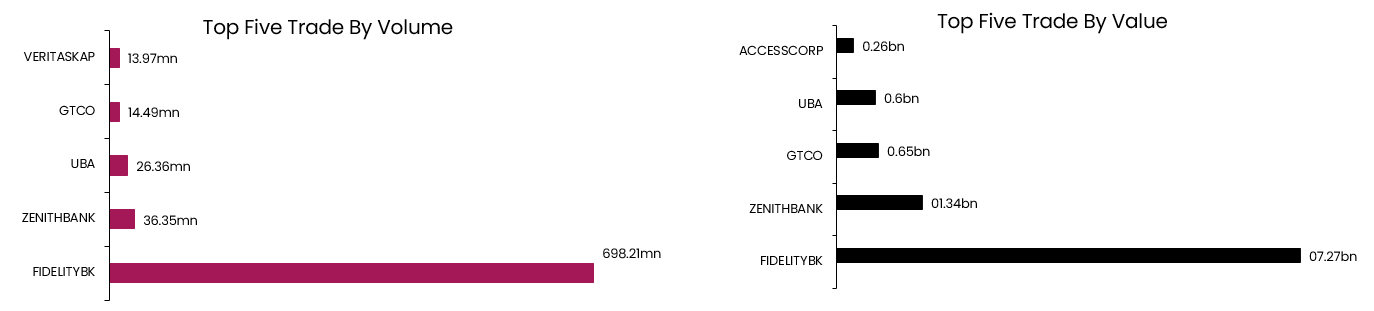

Furthermore, the market witness mixed trading activities as the total volume traded increased by 121.24% reaching 935.15mn units while the total value traded declined by 78.06% reaching NGN11.84bn. FIDELITYBK traded the highest in terms of both volume and value.

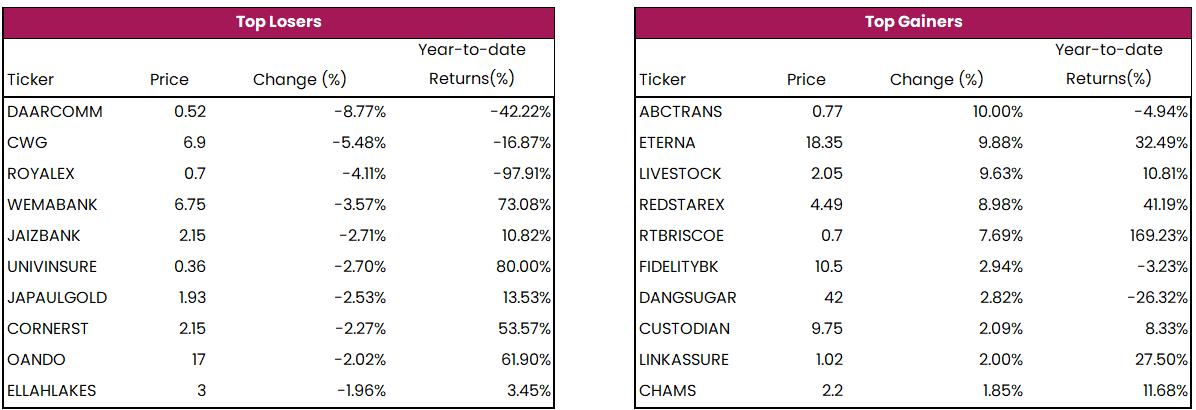

Today, ABCTRANS, ETERNA and LIVESTOCK led the gainers, while DAARCOMM, CWG and ROYALEX led the losers.

Daily Market Update (Fixed Income)

Today, the Nigerian Treasury bills (NT-bills) market closed on a positive note with the average yield down by 0.03% to settle at 22.46%. This is following buying interest across the tenors. Conversely, the FGN bond market closed on a negative note as the average yield rose by 0.16% to 18.94%. This is following selloffs in the MAR-2025 (+3.20%), JAN-2026 (+0.01%) and JUN-2033 (+1.39%) instruments. Overall, the Naira fixed income market concluded negative as the average yield rose by 0.07% to 21.20%.