Daily Market Update (Equities)

For the first time this week, the Nigerian Equities market closed on a positive note, as the NGX All Share Index added 0.17% to settle at 99,385.44 points. This pushed the market’s year-to-date (YtD) returns up to 32.91% (vs. Yesterday: 32.69% YtD). The positive performance in the market is on the back of gains in FBNH( 2.99%), ZENITHBANK (+1.42%), OANDO (+10.0%) and GTCO (+0.92%), offsetting losses incurred in UBA (-0.69%), CORNEST (-8.64%), STERLINGNG (-1.44%) and AIICO (-2.06%).

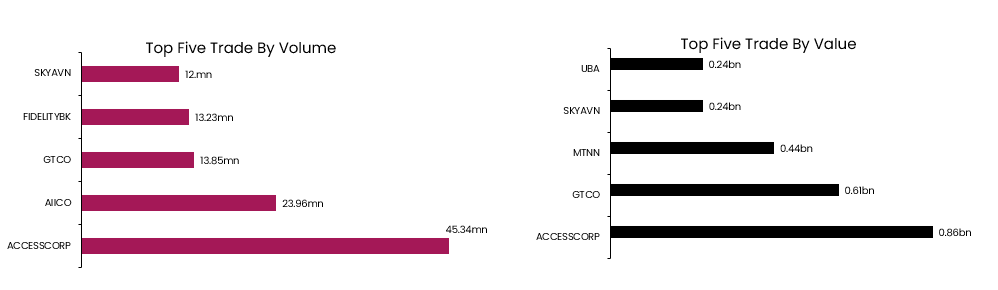

Today, total Volume and Value traded each decreased by 23.57% and 33.15% to 276.36mn units and NGN4.12bn respectively. ACCESSCORP led the charts in terms of both total Volume and Value traded for the day.

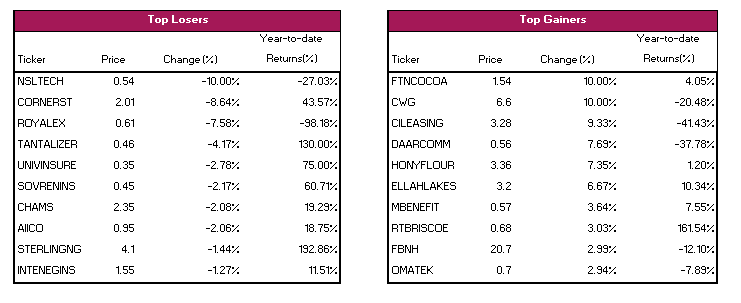

FTNCOCOA, CWG and CILEASING gained the highest today, while NSLTECH, CORNEST and ROYALEX led the laggards.

FTNCOCOA, CWG and CILEASING gained the highest today, while NSLTECH, CORNEST and ROYALEX led the laggards.

Daily Market Update (Fixed Income)

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market witnessed a positive close, following buying interest across all tenor bills. Consequently, average yield at the market declined marginally by 0.01% to 22.01%. Similarly, despite a mixed trading session, the secondary FGN Bond market closed positive, with the average yield losing 0.05%s to settle at 18.73%. For the most part, the Naira Fixed Income market closed positive, as the average yield fell by 0.03% to settle at 20.37%.