Daily Market Update (Equities)

The Nigerian equities market noted a positive performance today as the All-Share Index (ASI) increased by 0.55% to close at 98,762.78 points. Consequently, the year-to-date (YTD) return went up to 32.08%, from 31.36% on Tuesday.

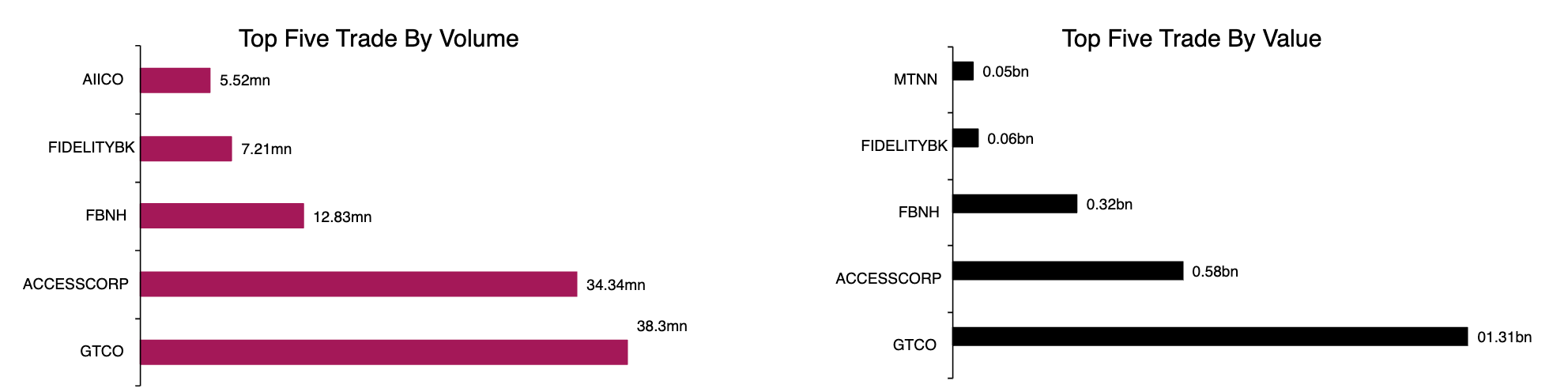

Today, the Total volume traded increased by 20.46% to settle at 665.20 meanwhile, the total value traded dipped 96.29% by 4.59% to settle at 277.27mn units and NGN5.54bn respectively. Today, GTCO traded the highest in terms of both Volume and Value.

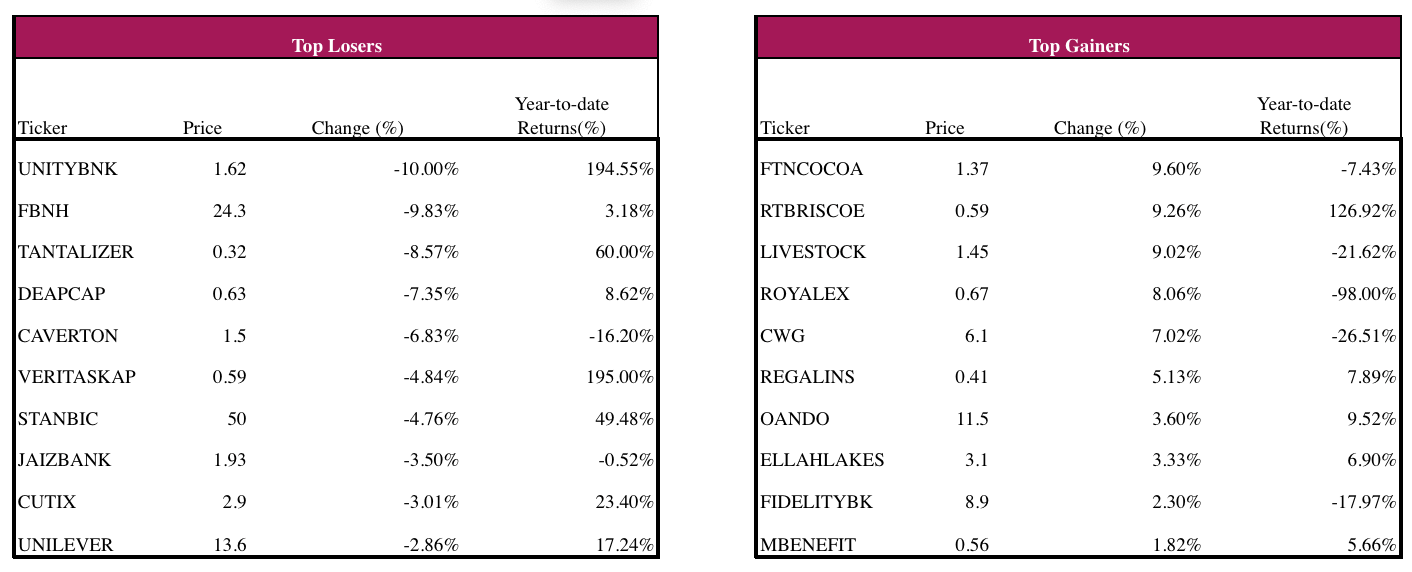

UNITYBNK, FBNH and TANTALIZER led the gainers, while FTNCOCOA, RTBRISCOE and LIVESTOCK led the laggers.

UNITYBNK, FBNH and TANTALIZER led the gainers, while FTNCOCOA, RTBRISCOE and LIVESTOCK led the laggers.

Daily Market Update (Fixed Income)

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market closed on a bearish note as average yield increased by 21bps to settle at 22.41%. This was driven by sell offs in the Mid and long tenor bills. However, the FGN bond market closed bullish, following significant buying interest along the mid-end of the curve. Consequently, average yield declined by 2bps to settle at 18.92%. Overall, the Naira fixed income market closed on a negative note as the average yield went up by 10bps to settle at 20.67%.