Today, the Nigerian equities market closed on a negative note as the bench mark index declined 0.43% to close at 64,928.98 points. Consequently, its Year-to-Date return printed at 26.69% (Yesterday: 27.24%). The weak performance was primarily driven by selloffs in Dangote Sugar Refinery PLC, FBNH Holdings PLC, Access Holdings PLC and United Bank for Africa PLC offsetting the gains in Zenith bank Plc, Wema Bank PlC, Corner Stone Insurance PLC, MTN Nigeria Communications PLC and Abbey Mortgage Bank PLC .

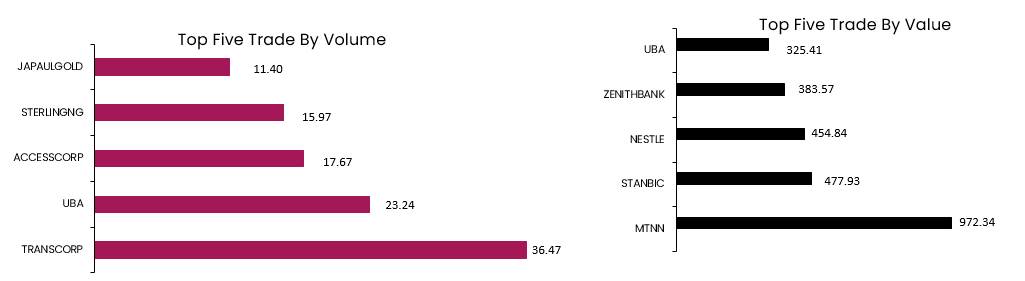

Today, TRANSCORP traded the highest in terms of Volume while MTNN traded the highest in terms of Value. Total Volume and Value traded for today settled at NGN280.47mn and NGN4.65bn respectively.

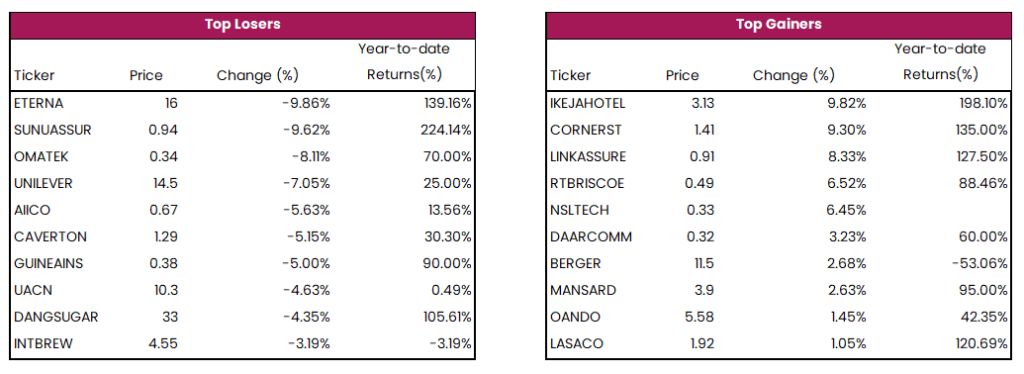

The top gainers for today were IKEJAHOTEL, CORNERST, LINKASSURE and RTBRISCOE while ETERNA, SUNUASSUR, OMATEK and UNILEVER topped the losers’ chart

Daily Market Update (Fixed Income)

Today, the Nigerian Treasury bills secondary market closed positive as average yield dipped by 0.05% to close at 7.25%. Meanwhile, the FGN bond market closed negative as average yield increased by 0.10% to close at 13.66%.