The Nigerian Equities market closed the day on a Negative note for the 3rd day this week as the NGX All Share Index (ASI) decreased by 0.86% to 101.227.42 points. Consequently, the market’s year-to-date (YtD) returns settled at 35.38% from 36.55% yesterday.

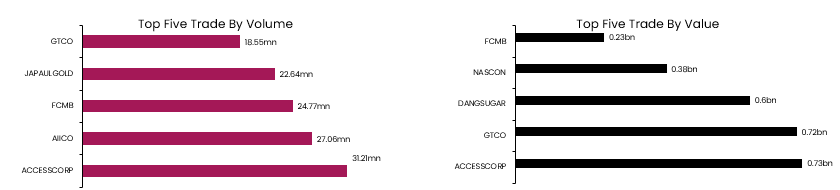

Total Volume and Value traded dipped by 39.91% and 11.97% each to 478.38mn units and NGN7.17bn respectively. Today, ACCESSCORP traded the highest in terms of both Volume and Value.

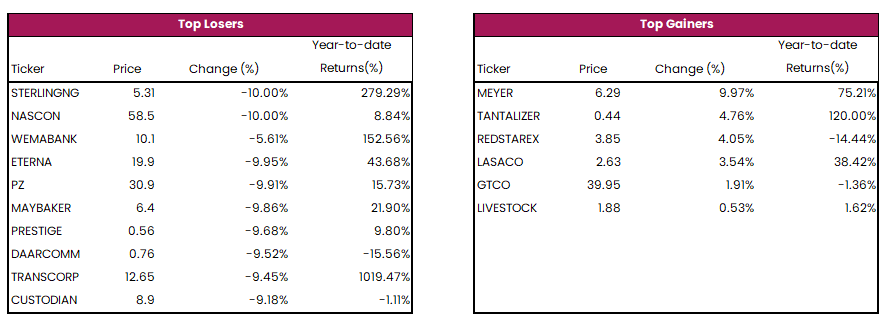

The top gainers for today include MEYER, TANTALIZER and REDSTAREX while, STERLINGNG, NASCON and WEMABANK topped the losers’ chart.

The top gainers for today include MEYER, TANTALIZER and REDSTAREX while, STERLINGNG, NASCON and WEMABANK topped the losers’ chart.

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market closed bearish as the average yield increased by 251bps to settle at 14.61%. This followed selloffs in the short and mid tenor bills. However, the FGN bond market closed quiet as the average yield remained constant at 15.31%. Overall, the Naira Fixed Income market closed bearish as the average yield increased by 126bps to settle at 14.96%.