Crude Oil: Will crude oil ‘roller coaster’ linger?

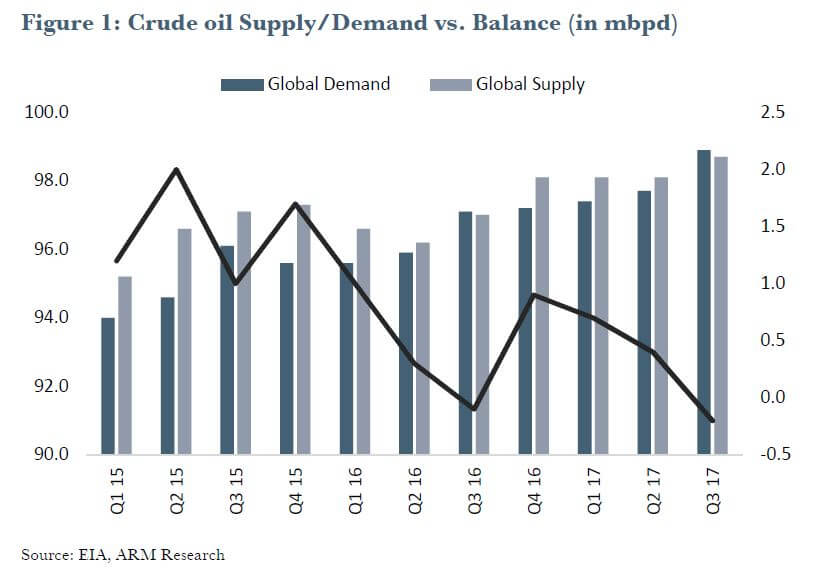

Crude oil market rebalancing in the third quarter of 2017 was ahead of our forecast, as US oil production was partially disrupted by the Hurricane while OPEC stuck to its pact. For context, at the start of the quarter, we had forecasted a slower rebalancing of the crude oil market with excess supply projected to decline to 100kbpd (Q2 17: 400kbpd). This view was hinged on quick increases in shale production, which we expected to moderate the impact of rising demand and OPEC’s production cut.

Irrespective, the impact of hurricane on production made our earlier call look too pessimistic, after having stoked a faster than expected rebalancing. Precisely, crude oil market switched to a deficit in the quarter (-160kbpd) to drive a bull run in the commodity price.

Further examination of the crude oil market reveals increases in global crude demand over the review period to 98.9mbpd (1.6% QoQ) largely reflecting growth in the OECD region (2.0% QoQ to 47.6mbpd). The growth was driven by rising European demand, a reflection of positive vehicle sales, combined with increases in demand stoked by the re-opening of US refinery.

Nonetheless, demand was relatively sticky in China and India as economic recovery remained slow. At the other end, the market witnessed increases in supply (1.0% QoQ to 98.7mbpd), but the momentum was slower than earlier expected. For us, the mild increase in supply was on the back of further crude production cut by Russia as well as slower than expected rise in US shale activities. Specifically, following Hurricane Harvey which led to a 186kbpd unplanned production outages, US’s supply came in only slightly higher relative to prior quarter (+280kbpd).

This, in addition to the 300kbps cut in Russia’s production, was enough to offset the impact of a rise in OPEC’s supply that was triggered by higher supply from previously battered members: Nigeria (+176kbpd) and Libya (+230kbpd). On balance, a tamer crude supply picture (relative to demand) led to the much-needed rebalancing in the crude oil market in the review period.