Following the successful re-election of President Muhammadu Buhari into office this week, it appears that the macroeconomic landscape for the rest of the year seems unchanged from 2018 with the obvious deviation being the prospect for a lower crude oil price this year, in our view. To buttress, our forecast for average crude oil prices in 2019 is $55.95/bbl. which is in sharp contrast to the $60/bbl. in FG’s 2019 fiscal outlay. No doubt, this has far-reaching effect on FG’s finances given that oil receipts still account for the largest chunk of FG’s foreign currency receipts and its non-oil ambitions have consistently fallen below par. As a result, bearing in mind the devastation on the naira caused by lower crude oil prices in 2016/17, the CBN is in for a tug of war in its defense for the naira this year.

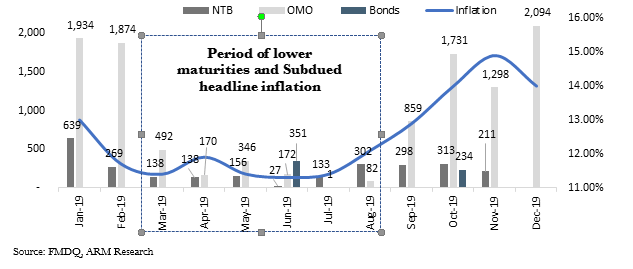

In fact, the recent spurt of OMO issuances (YTD Net OMO sale: N398.2 billion) and the re-introduction of stabilization securities are indications that the CBN is not sparing any ammunition in its defense of the naira. That is not to say that we anticipate an overly proactive CBN with monetary tightening all through the year. We hold the view that the concentration of fixed income maturities which relapses after Q1 19 before picking up in Q4 19 and our case for downslide in headline inflation mid-2019 provides room for lesser monetary tightening between March and September. This could either come in form of an outright reduction in OMO rates by the CBN or withdrawal of the one-year OMO bill to enforce a loose monetary policy. Farther out, our view about NGN depreciation towards the end of the year and higher fixed income maturities suggests that the apex bank could return to liquidity curbing tactics over Q4 19 to ward off speculative attacks on the NGN.

On the fiscal side, the lack of guidance on possible refinancing of maturing Fixed income securities this year alongside our expectation for lower crude oil prices points to higher fiscal borrowings over 2019. While this suggests higher yields over 2019, we do not see sizeable upside for bond yields in Q1 19. Our expectation is hinged on knee jerk buying post-election by both foreign and local investors which would spur bullish run in yields over the first quarter. Meanwhile, at the short end, while we expect FG’s quest to reduce its cost of debt service to trigger strict compliance with its Q1 NTB calendar, we see room for a ramp up in borrowing at the short end beyond Q1 19 due to subdued NTB maturities.

2019 Maturity profile vis a vis ARM Inflation forecast

Having framed our outlook, we see merits in maintaining a short duration strategy over Q1 19, taking advantage of higher yields emanating from CBN’s quest to rein on elevated liquidity levels over the period. This strategy helps to avoid the bullish run in bond yields over the first quarter of the year, tailing the knee jerk buying after the election by both foreign and local investors. Similarly, in Q2 and Q3 19 when the impact of lower liquidity levels, tamer inflationary pressures and our expectation for a lesser monetary tightening stance comes to play, investors should play at the very short end of the naira yield curve in a bid to ‘run-down the curve’ in the latter part of 2019. Farther out, as we approach a more bloated maturity profile in the hindmost of Q3 19 and Q4 19, and currency pressures become self-evident, we advise a firm build up in longer dated maturities. This view is corroborated by our prognosis for a ramp in paper supply at the long end of the curve after legislative accent to the budget in the latter part of the year.

For the full report, contact ARM Research at research@armsecurities.com.ng