Daily Market Update (Equities)

The Nigerian equities market began the week on a negative foot, as the NGX All Share Index (NGX ASI) lost 0.73% to 97,881.75 points. This is following losses incurred in BUACEMENT (-11.33% to NGN114.30), TRANSCORP (-1.42% to NGN96.90) and ZENITHBANK (-0.77% to NGN38.55), which offset gains in OANDO (+9.98% to NGN44.65), DANGSUGAR (+9.95% to NGN40.35) and JBERGER (+10.00% to NGN121). Consequently, the market’s year-to-date (YtD) return fell to 30.90%.

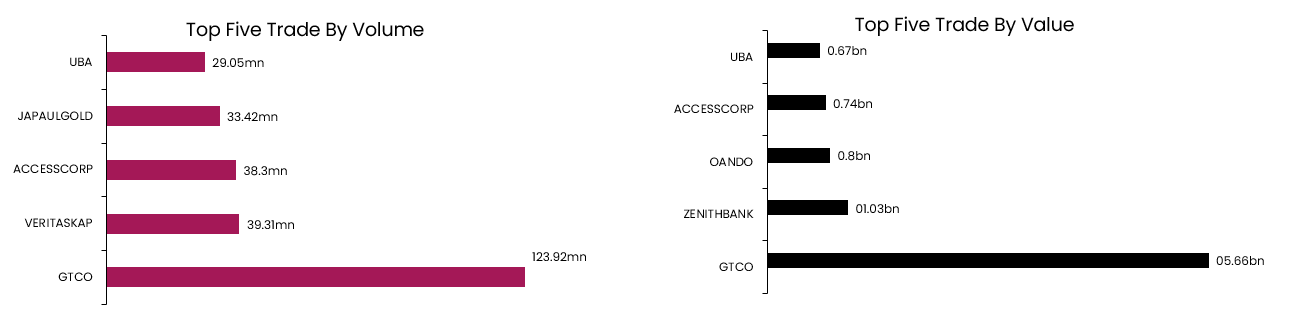

However, market activity was positive, with total volume and value traded increasing by 4.36% and 44.11% each to 498.27mn units and NGN11.77bn respectively. GTCO led both the volume and value traded charts.

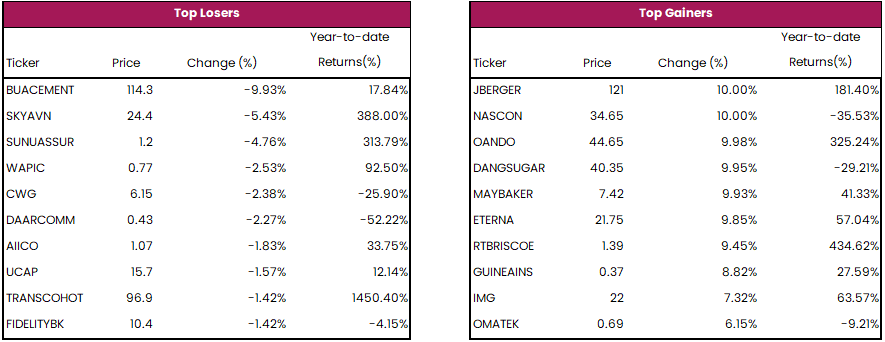

Top gainers today were JBERGER, NASCON and OANDO. On the other hand, BUACEMENT, SKYAVN and SUNUASSUR topped the losers’ chart.

Daily Market Update (Fixed Income)

Today, the Nigerian Treasury bills (NT-bills) market concluded on a positive note as the average yield declined by 0.17% to settle at 25.64%. This was driven by buying interest in the long tenor bill. Likewise, the FGN bond market witnessed positive sentiment with the average yield down by 0.04% to close at 20.01%. This is following buying interest in the MAR-2025 (-0.04%), JUN-2033 (-0.34%), FEB-2034 (-0.54%) and JUN-2053 (-0.42%) instruments. Overall, the Naira fixed income market ended bullish as the average yield fell by 0.10% to 22.82%.