Daily Market Update (Equities)

The Nigerian equities market started negative on note, as the NGX All-Share Index (NGX ASI) went down by 0.53% to close at 101,777.12 points. Consequently, the market’s year-to-date (YTD) returns dipped to 36.11%, down from Friday’s closing of 36.83%.

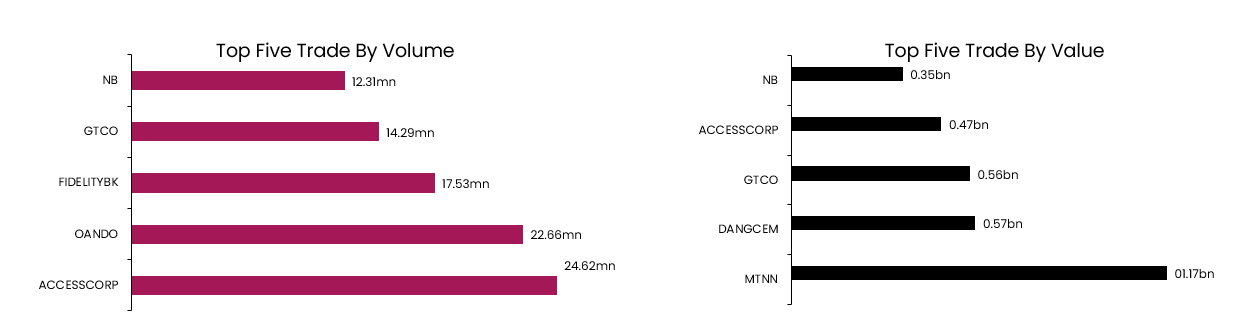

Trading activity also saw a significant decline today. Total volume and value traded dropped by 55.50% and 66.79% respectively, settling at 326.64mn units and NGN7.17bn. MTNN was the most traded stock by volume, while ACCESSCORP led in terms of the value traded.

Top gainers for the day were MORISON, NEM and DAARCOMN, while the top losers were FIDELITYBK, JAIZBANK and RTBRISCOE.

Daily Market Update (Fixed Income)

Today, the NT-bills secondary market witnessed a mixed trading session but, however closed positive, as average yield declined by 0.08% to 18.78%, following buying interest in long-tenor bills. On the other hand, the secondary FGN Bond market traded silently albeit closed on a negative note, as investors turned their focus to the primary bond auction held today. Consequently, average yield increased marginally by 0.01% to 19.27%. For the most part, the Naira Fixed Income market closed positive as average yield declined by 0.04% to 19.02%.