Daily Market Update (Equities)

Today, the Nigerian equities market extended its downward trend for the consecutive trading day this week, as the NGX All Share Index (NGX ASI) declined by 0.50% to 97,390.01 points. As a result, the market’s year-to-date (YtD) returns dipped further to 30.25% compared yesterday’s 30.90% YtD returns.

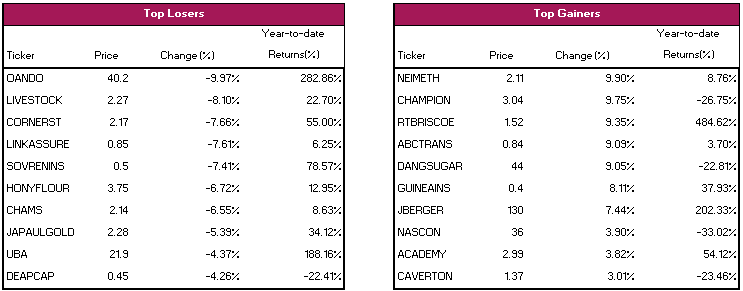

The negative sentiment witnessed was propelled by losses incurred in BUACEMENT (-3.94% to NGN109.80), OANDO (-9.97% to NGN20.20) and ZENITHBANK (-4.02% to NGN37.00), which offset gains in DANGSUGAR (+9.05% to NGN44.00), JBERGER (+7.44% to NGN130.00) and WAPCO (+0.82% to NGN37.00).

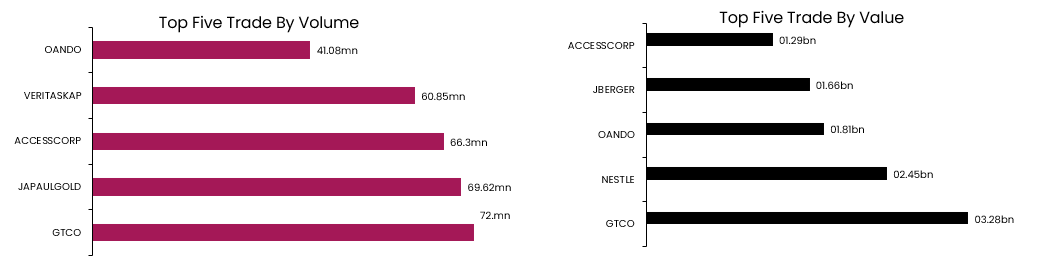

Market activity remained robust, with total volume and value traded increasing by 20.26% and 18.23% respectively to 599.25mn units and NGN13.92bn. GTCO maintained its top position in both volume and value traded for the second consecutive day.

Top gainers today were NEIMETH, CHAMPION and RTBRISCOE. On the other hand, OANDO, LIVESTOCK and CORNERST topped the losers’ chart.

Daily Market Update (Fixed Income)

Today, the NT-bills market extended its positive run for the consecutive day as the average yield declined by 0.07% to close at 25.56%. This is following buying interest across the tenors. On the same note, the FGN bond market closed positive with the average yield down by 0.03% to 19.97%. This was driven by buying interest in the MAR-2025 (-0.01%) MAY-2033(-0.48%), JUN-2033 (-0.24%), FEB-2034 (-0.39%) and MAR-2050 (-0.08%). Overall, the Naira fixed income market witnessed positive sentiment as the average yield fell by 0.05% to 22.77%.