Times like this call for deliberate spending and cost cutting wherever possible, including data usage. Follow our guide below to save on your data expenses and preserve your money for other necessities.

Turn off your data at night

Research has proven that more people are getting less quality sleep because of the incessant need to check their phones during the night. Turning off your data at night will give you a good night’s sleep and help you save on data.

Set a time for social media

Consider dedicating a time of the day to social media, could be during your lunch break or while you are in traffic. Not only would you have time for other things, you’ll also save on data.

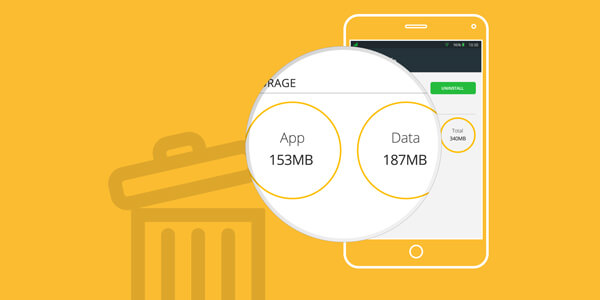

Downsize your apps

Apps run on data and are programmed to update often. Reducing your app collection will reduce your data spend and provide your phone increased storage space to function better.

Reduce your Whatsapp groups

Do you sometimes get the same image or message from two or more of your Whatsapp groups? If the answer is yes, you are probably on too many Whatsapp groups. This might be a good time to exit some of those groups that drain your data and leave your phone beeping all night.

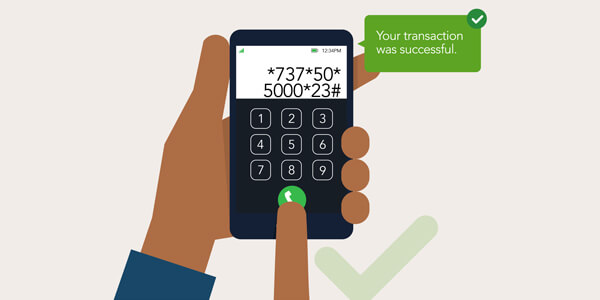

Try data free investing

Yes, you can make investments without using one kilobyte of data or logging into your internet banking portal. For instance, you can conveniently and securely initiate new investments and top up existing investments on your ARM Investment account by simply dialling *737*50*amount*code#.

No Data, No Issues. Invest with our USSD Codes. Learn more here.

Kola ideally should not take a loan for a vacation.

However, there might be other considerations – is the vacation discounted during this period? Will it be much more expensive in December? Can Kola and his wife take their annual leave in December? Are the children on holidays in December? Is the loan interest free or of low interest?

Thanks for your response Rotimi. As you have rightly stated, there might be other considerations. However, all things being equal, saving is often a better financial move compared to borrowing. While one contributes to the future, the other takes away. Please keep reading and commenting.

This is the perfect webpage for anyone who wishes

to find out about this topic. You understand a whole lot its

almost tough to argue with you (not that I actually would want to…HaHa).

You certainly put a new spin on a topic which has been written about for decades.

Excellent stuff, just great!

Thank you, we appreciate your kind words. Please keep reading and commenting.

Debt (interest or none interest) is only good if it brings investment value (i.e. profit)….debt for consumption only means more debt…exposing oneself to more debt is dangerous and should be avoided…..cut your coat according to your cloth – not even size!

I am regular reader, how are you everybody? This post posted at this website is actually good.

They are genuinely wonderful ideas in about blogging.

You possess touched some nice points here. In any manner continue wrinting.

This is very interesting, You are a very skilled

blogger. I have joined your feed and look forward to seeking more of your excellent post.

Also, I’ve shared your web site in my social networks!

I need to to thank you for this fantastic read!!

I certainly enjoyed every small amount of it. We have got you bookmarked to think about new stuff you post